Spring is certainly in the air for investors. The index finished up for the month, and while the pace of this growth is likely unsustainable, there are reasons to be optimistic that the returns can continue to stay positive for the remainder of the year.

By Matthew Suarez, Vice President & Portfolio Manager

The quadrennial spectacle of the United States presidential election often brings with it a whirlwind of speculation and anticipation, not only in political circles but also in the financial realm. Conventional wisdom suggests that the outcome of such a monumental event could yield considerable influence over stock market performance. However, empirical evidence and economic analyses paint a different picture altogether, debunking the notion that the US presidential election significantly affects stock market outcomes.

Numbers don’t lie.

Historical data spanning decades reveal a lack of substantial correlation between presidential elections and stock market movements. While it’s true that markets may experience short-term volatility in the lead-up to and aftermath of an election, these fluctuations are typically transient and tend to normalize in the long run. Studies examining market behavior during election years consistently demonstrate that market trends are driven by a myriad of factors, including economic indicators, corporate earnings, geopolitical events, and monetary policies, rather than the identity of the sitting president or the outcome of the election.

One key reason why presidential elections have minimal impact on stock market outcomes is the limited influence that a single political event can exert over the complex and multifaceted global financial system. Stock markets are inherently forward-looking and are influenced by expectations regarding future economic conditions, corporate performance, and policy developments. Consequently, investors and market participants tend to focus more on fundamental economic indicators and structural factors rather than short-term political events.

While elections can certainly be an emotional time, they are not the time to make drastic investment decisions based solely on election outcomes.

Let’s look at the bigger picture.

The US presidential election is just one component of a broader political landscape that encompasses legislative bodies, regulatory agencies, and geopolitical dynamics. The composition of Congress, the Federal Reserve’s monetary policy decisions, trade agreements, and international relations arguably wield greater influence over economic trends and market performance than the outcome of a single election. For instance, major policy shifts such as tax reforms, regulatory changes, or fiscal stimulus packages can have far-reaching implications for businesses, industries, and financial markets, irrespective of who occupies the White House.

Another factor mitigating the impact of presidential elections on stock markets is the concept of political gridlock. In a system characterized by checks and balances, the ability of any single branch of government to enact sweeping policy changes is often constrained by political polarization and institutional barriers. Divided government, where different parties control the executive and legislative branches, can result in legislative gridlock and policy inertia, which may reassure investors by maintaining stability and preventing radical policy shifts that could unsettle markets.

Where’s the proof?

Where’s the proof?

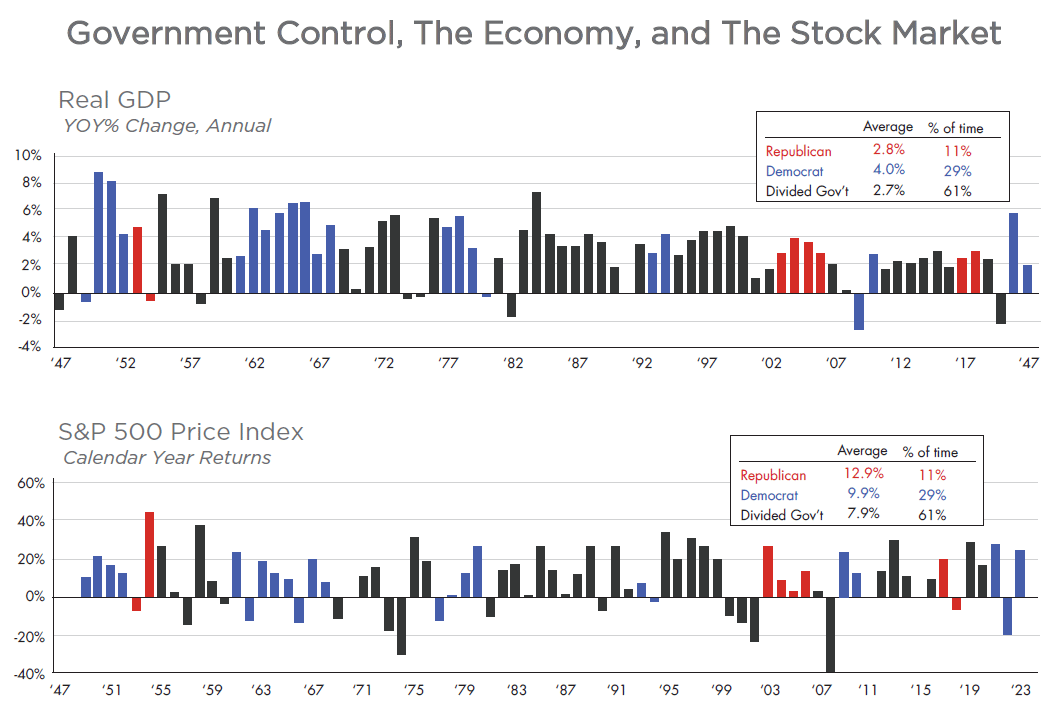

The attached chart, Government Control, the Economy and Stock Market, shows 80 years of historical data regarding the economy (GDP) and the stock market (S&P 500 Price Index). When the chart indicates a red “Republican” year, that means that the Republicans control the Presidency and the majority in both the House and the Senate. The same is true for the Democrats in a “Democrat” year. “Divided Government” just means some combination of Democrat and Republican control of these three bodies. As the chart illustrates, regardless of the political makeup after an election, both the economy and the stock market have positive average movement.

Investors know the drill.

Investors are adept at adapting to changing political landscapes and incorporating political risk into their decision making processes. Market participants often engage in scenario analysis and risk assessment to gauge the potential impact of different electoral outcomes and policy proposals on asset prices and investment strategies. Consequently, market reactions to election results are often more subdued than anticipated, as investors have already priced in various electoral scenarios and adjusted their portfolios accordingly.

It’s worth noting that while presidential elections may not have a direct and immediate impact on stock market outcomes, they can still influence market sentiment and investor confidence to some extent. Perceptions of political stability, leadership competence, and policy continuity can shape investor sentiment and affect risk appetites in the short term. Nevertheless, these effects are typically short-lived and tend to dissipate as market participants refocus their attention on economic fundamentals and corporate performance.

In conclusion…

While the US presidential election may captivate the public’s attention and generate headlines, its impact on stock market outcomes is often exaggerated. Empirical evidence and economic analysis consistently debunk the myth that presidential elections significantly influence stock market performance. Investors and market participants would be wise to maintain a long-term perspective and focus on fundamental factors rather than succumbing to election-induced market hysteria.