Our goal at Central Trust Company is to provide you with accurate and timely tax information. To accomplish this, we generally await receipt of final tax information before issuing your tax forms to ensure the information is as accurate as possible. We would like you to be aware that some companies in which we hold investments on your behalf are not able to provide final tax information to us until late February or early March, resulting in a delay in the delivery of your tax forms to you.

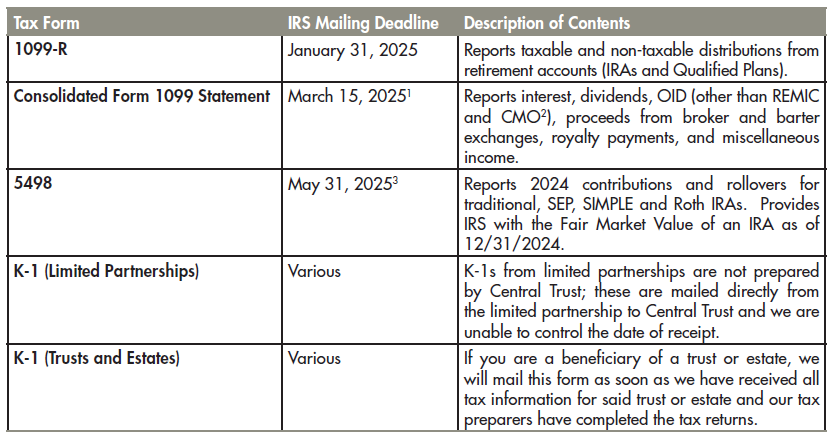

The IRS provides dates by which we are required to mail certain tax forms. The table below shows the IRS mailing deadline for various forms. Despite these IRS prescribed deadlines, we will provide you with your tax forms as soon as your data is available. If you have multiple accounts with Central Trust Company, Forms 1099 may be mailed on different dates. Additionally, if your investment or IRA account moved to Fidelity in 2024 from an existing Central Trust Company account, you will receive tax reporting forms from both Central Trust Company and Fidelity for tax year 2024. Please confirm that you have received all tax reporting documents before filing your tax return.