May saw markets rebound as tech and consumer stocks surged, offsetting bond losses and debt concerns. International equities outpaced U.S. gains, while gold cooled but remained a top performer.

Investment Outlook

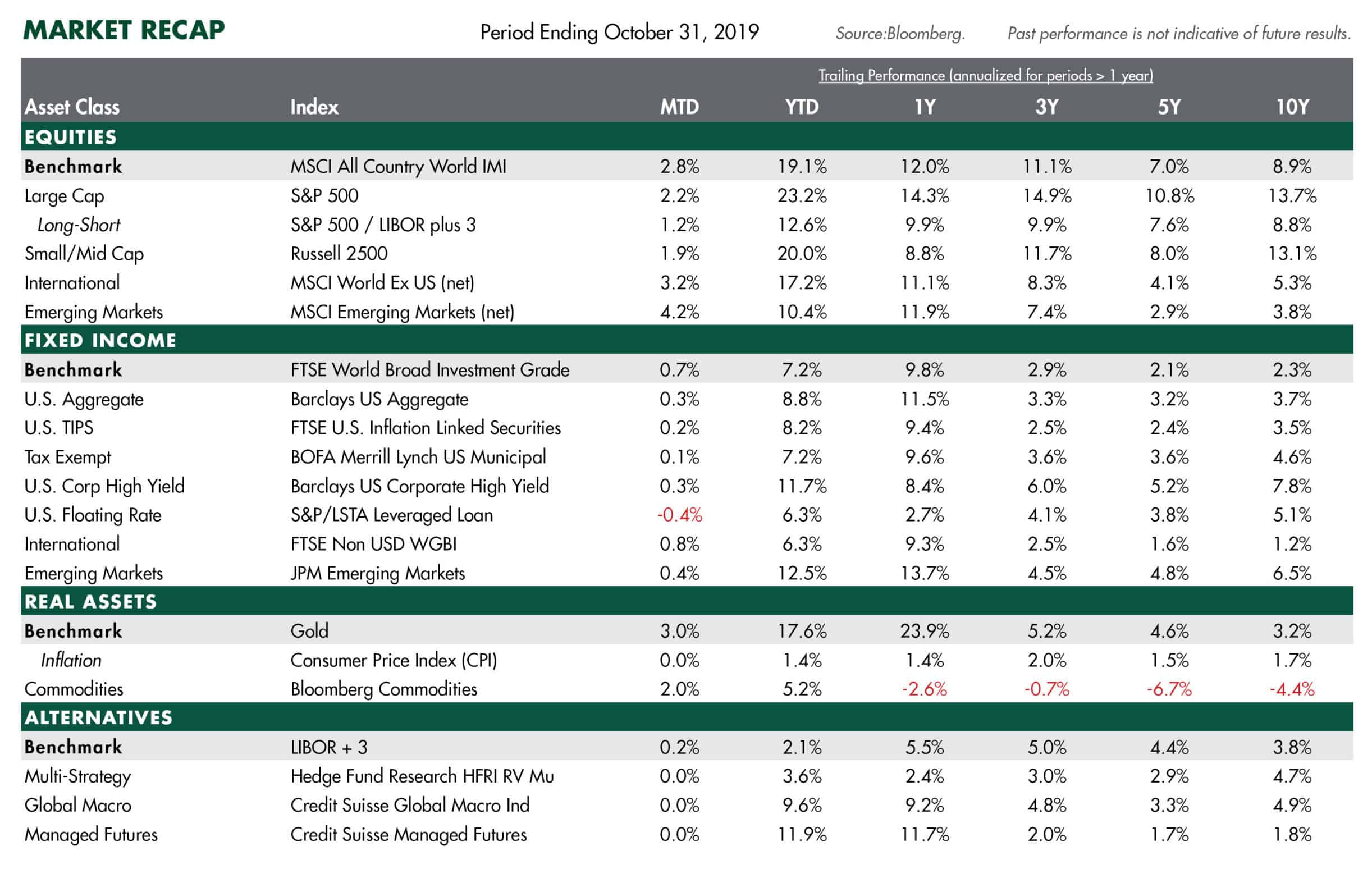

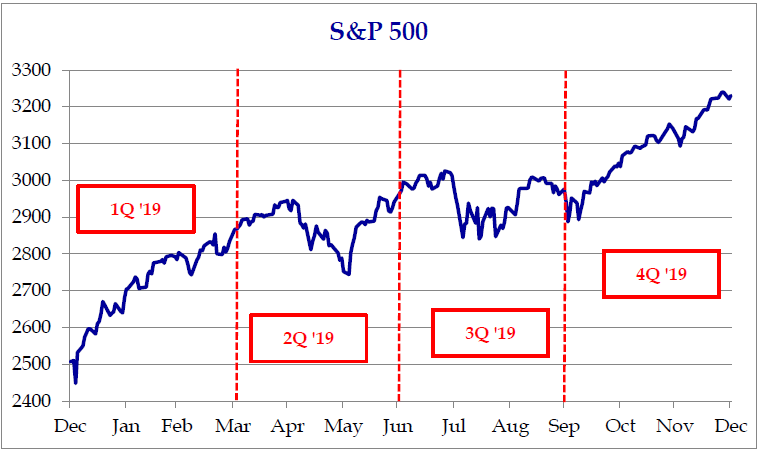

2019 was a much better year than expected with excellent investments returns. All major asset classes posted stellar returns, many registering their best gains in a decade. U.S. equity markets led global markets higher as stock markets across the globe hit record highs. U.S. stocks broke out above a narrow trading range that they were in for nearly two years (Figure 1). The key drivers were global monetary easing by Global Central Banks, a trade truce between the U.S. and China and better prospects for an orderly Brexit.

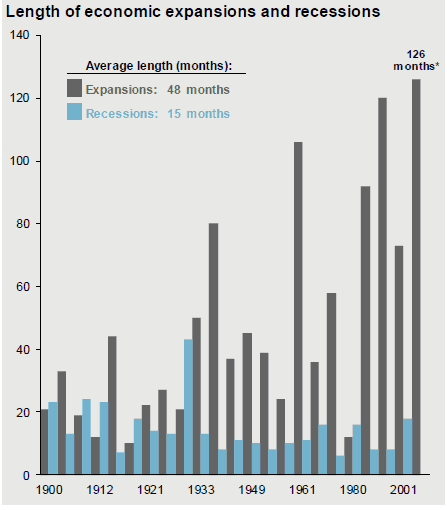

The U.S. economic expansion became the longest expansion in postwar history (Figure 2). This expansion has also had the slowest growth, contributing to its longevity. Unemployment hit a 50- year low, inflation remained subdued under 2% and interest rates surprised to the downside.

Trade

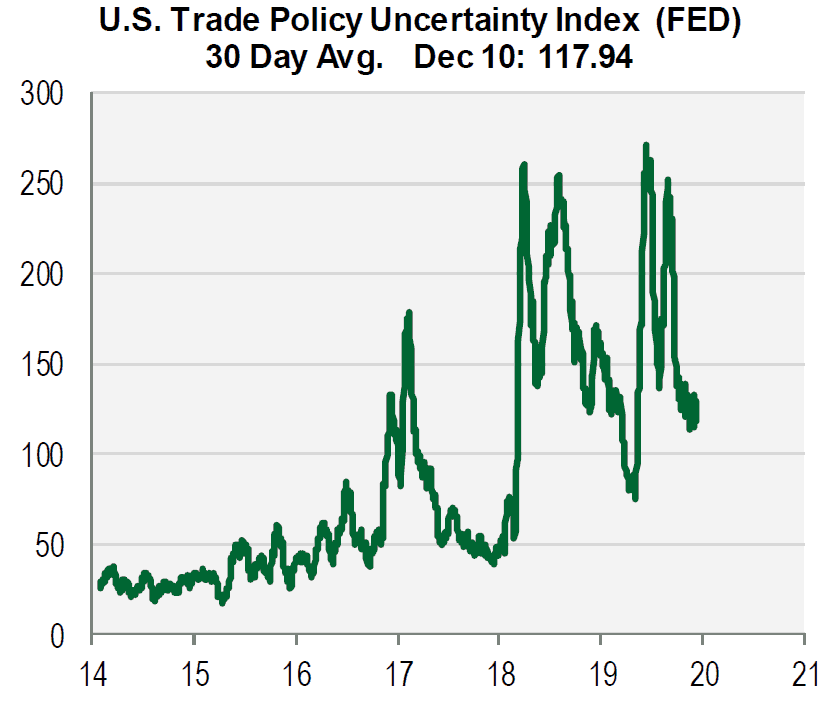

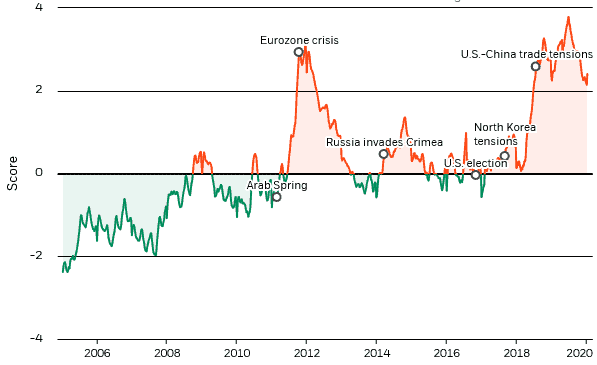

2019 ended with a flurry of positive news on trade. Trade tensions had caused investors angst throughout much of the year (Figure 3). The U.S. and China agreed to a Phase 1 trade agreement that halts additional tariffs and boosts U.S. exports to China. The United States-Mexico-Canada Agreement (“USMCA”) was passed by Congress to replace NAFTA, and a UK election has increased the likelihood of an orderly Brexit.

These trade agreements are supportive of a moderate global recovery in 2020.

Growth

Global growth was beginning to synch lower in part due to global trade tensions that caused manufacturing activity to turn lower. Global Central Banks led by the Fed responded by easing monetary policy and interest rates to push back against slowing growth and trade disruptions to support the current economic expansion. Global central banks remain accommodative and have been easing financial conditions.

The Fed

The Federal Reserve expanded its balance sheet again toward the end of last year after lowering interest rates three times in July, September and October. Importantly, after the rate cuts, the yield curve is no longer inverted in the U.S., which is positive for the financial sector and growth.

The Fed is likely to be on hold throughout 2020 particularly as we approach mid-year with the upcoming presidential election in November. In the last meeting, the Fed signaled it is on hold for now. The Fed has stated that the bar for raising rates is high and a significant increase in inflation would have to be “persistent” before they would consider raising rates. If the Fed were to act it would likely be to cut interest rates if growth falters.

U.S. Economy

Growth has slowed in the U.S from 3% to the 2% level, remaining the best of the G-7 countries. The consumer is a significant part of the U.S. economy, accounting for 70% of GDP. With wage growth doubling to over 3%, real wages rising and unemployment dropping to a fifty year low, the consumer sector remains strong. The strength in the consumer sector has offset weakness in business capital spending and the manufacturing sector. With a strong U.S. consumer and an uptick in global growth, a recession is unlikely this year. We are closely watching the U.S. labor market and consumer confidence for signs of deterioration.

Inflation

Inflation has been stubbornly low over the last decade. Almost all major central banks have been unsuccessful in attempting to lift inflation toward their 2% target in order to offset the deflationary forces of global competition, high debt levels and technology innovation. The Fed has stated it is willing to let inflation rise above 2% for a period. Overall, inflation is likely to remain subdued in 2020, but the balance of risks are tilted toward higher inflation and needs to be carefully monitored.

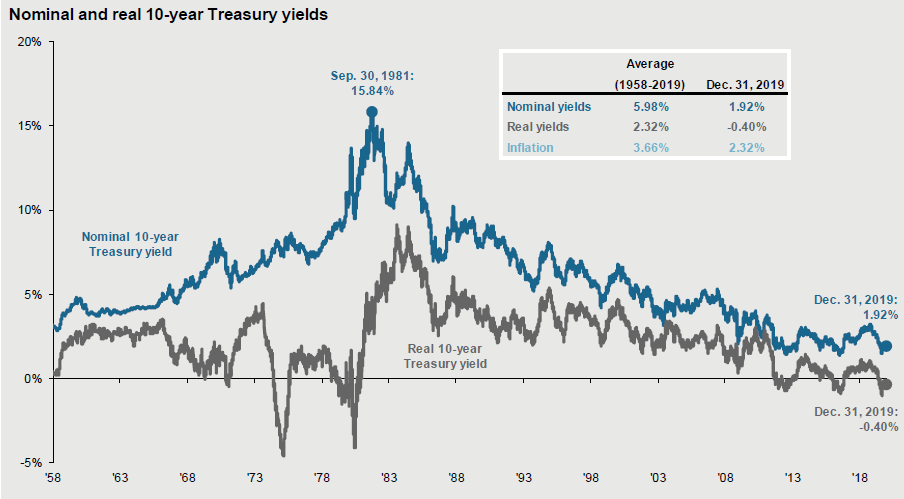

Interest Rates

Bond investors benefited from a significant fall in yields in 2019. The U.S. 10-year Treasury yield climbed to over 3% in March only to fall to 1.4% before ending the year at 1.88%. Bond returns will likely not have the tailwind of lower rates in 2020. Several factors point to higher yields, including global growth edging higher, wage gains, tariffs and rising fiscal deficits. With interest rates across the globe near historic lows (Figure 4), central banks are nearing the limits of further monetary accommodation to stimulate growth.

Earnings

S&P 500 operating earnings in 2019 were essentially flat at $162. Profit margins remain near peak levels and face headwinds from rising wages and higher input prices. Earnings estimates will likely be revised lower for 2020 but should grow 4 – 6% as trade tensions ease and global growth edges up. The stock market needs earnings to grow as valuations are stretched.

Valuations

Stock market gains in 2019 were driven almost entirely by an expansion in the price-earnings multiple. The forward operating PE multiple was 14 times earnings at the beginning of 2019. Entering 2020, the current PE is at 19 times earnings, which is above the long-run 25-year average of 16 times earnings.

Valuations are a very poor indicator of stock market returns over the subsequent one and two year periods. However, higher valuations do point to lower equity returns over the following five to ten year holding periods.

Risks

Geopolitical risk remains elevated (Figure 5). The U.S. and China are likely to be engaged in strategic competition long-term despite the recent signing of a Phase 1 trade agreement. The decoupling of supply chains will result in slower growth on the margin. The recent escalation in U.S.-Iran tensions underscores the potential of regional conflicts. Global populism is raising political uncertainty across the globe.

Outlook

Our baseline outlook is for a moderate pickup in global growth underpinned by continued monetary accommodation and recent supportive fiscal policies in major global economies. However, the recent outbreak of the coronavirus will likely dampen growth in the first half of 2020. We also recognize that global central banks have dampened risk and volatility. This has elevated asset prices, making financial assets vulnerable to macro disruptions. We see a range of geopolitical and political risks that could cause volatility to rise. Risks include a renewed bout of trade tensions between the U.S. and China, Middle East turmoil, macro surprises and uncertainty around the U.S. elections. Monetary policy and lower interest rates are likely nearing the point of exhaustion as a tool to stimulate economies. Asset market returns will moderate as additional multiple expansion is likely limited.

INVESTMENT IMPLICATIONS: Portfolio Positioning

Against the backdrop of a late cycle environment, global growth that is stabilizing, higher geopolitical uncertainties and asset prices that are elevated, we are sticking close to our long-term strategic target allocations. We are overall neutral in equities and fixed income allocations after being overweight in equities and underweight in bonds for most of the last decade.

We remain positive on U.S. equities and have been overweight due to stronger U.S. economic growth, earnings and policy. We are overweight in large-cap versus small-cap, emphasizing quality and lower credit risk. Global growth overseas has been slowing in Europe, Japan and China, and policy risks abound. This has led us to an underweight in international equities and a preference for U.S. equities. With trade tensions easing and a modest pickup in global growth, we see the outlook improving for emerging market equities.

In fixed income, we expect interest rates to increase in 2020 as global growth edges higher and trade tensions recede. We favor the U.S. where relative yields are higher and there is greater scope for Fed easing in the event of weakening macro conditions. The higher yields in the U.S. provide greater ballast for portfolios to hedge equity risk in downturns.

As an inflation hedge, we have an allocation to U.S. Treasury Inflation-Protected Securities (TIPS) with TIPS breakevens at

low levels. We are avoiding international investment grade bonds due to lower interest rates. We favor shorter duration, high quality U.S. bonds due to a relatively flat yield curve. We have reduced allocations to the credit sector due to near record tight spreads and late cycle concerns where credit sector risk increases.

In a late cycle environment with low interest rates, forward looking asset class returns are lower than historical averages. Volatility across asset classes remains near historically low levels and will likely rise over time. Our dynamic tactical asset allocation continues to enhance returns and reduce risk.

MARKET RECAP (December 31, 2019):

- In 2019, all the major asset classes posted very strong gains, the best in a decade. U.S. equities led with the S&P 500 advancing 31%. U.S. outperformed international stocks as international developed equities gained 22% and emerging market equities rose 18%. Both were held back by a stronger U.S. dollar, weaker growth and higher exposure to trade tensions due to higher exports.

- The yield on the 10-Yr. U.S. Treasury bond dropped sharply to 1.88% after being above 3% earlier in the year. In the credit sector, floating rate loans and high yield recovered from losses in the fourth quarter of 2018 and gained 8% and 14%, respectively. Credit spreads are very tight across the credit sector as defaults remain low and relative yields are attractive.

- WTI oil prices jumped $15 in 2019 to $56 per barrel. Commodities rose 7% for the year.

- Gold broke out to the upside on rising geopolitical concerns and gained 18% for the year, the second best performing asset class after equities. Alternatives posted solid returns in the fixed income surrogate segment.