While elections can certainly be an emotional time, they are not the time to make drastic investment decisions based solely on election outcomes.

by Greg Berg, CFA, CAIA, MBA, Senior Vice President & Senior Portfolio Manager

INVESTMENT OUTLOOK

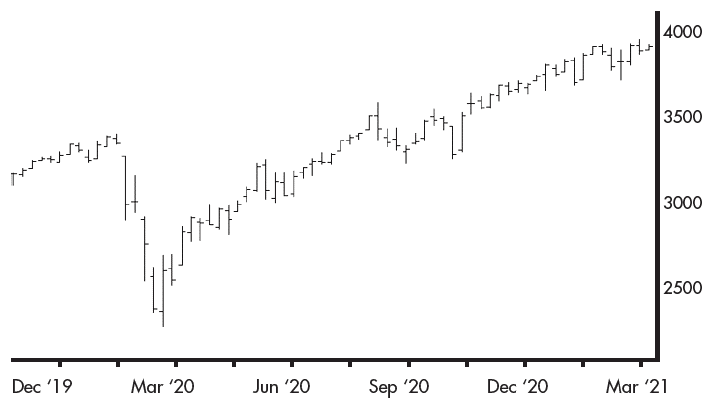

Investor optimism is high as massive, coordinated monetary and fiscal stimulus continues to underpin a global bull market in equities. U.S. equity markets rose to record highs in March, along with household income (Figure 1). Policy makers are providing maximum liquidity to the economy to spur growth and lower unemployment which stands at 6.2%. There are signs of speculative excess and valuations are stretched. Bond yields have risen while the yield curve has steepened as the growth outlook has improved, the vaccine rollout gains steam and Congress passed an additional $1.9 trillion stimulus bill.

HIGHLIGHTS

- We see rising estimates of growth as vaccination rates improve, the economy reopens and massive fiscal and monetary stimulus underpins risk assets. The U.S. economy may grow in the 7-9% range in 2021, the highest rate of growth since the early 1980s.

- Good news on the virus front as cases, hospitalizations and deaths have plunged. At the current rate, 75% of Americans could be vaccinated by August.

- The next few months could be bumpy as spikes in inflation and rising Treasury yields cause volatility in global asset markets.

- We maintain a pro-growth stance as our base case is stronger global growth over the balance of 2021. We are overweight equities and underweight fixed income and have inflation-linked bonds and precious metals for inflation protection and diversification.

FISCAL POLICY

The recently enacted $1.9 trillion American Rescue Plan is in addition to the $2.2 trillion CARES Act passed earlier in 2020 and the $900 billion package passed in December. The three bills total an unprecedented $5 trillion in spending over the last year, which is over six times the $800 billion package enacted during the Great Financial Crisis in 2008-09.

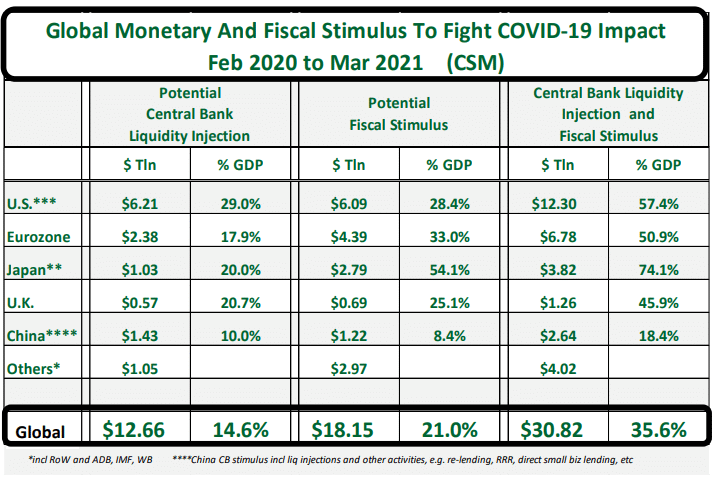

The combined global fiscal and monetary stimulus to fight Covid-19 has been massive and unprecedented. In the U.S., the combined stimulus to date has been over $12 trillion, which equals 57% of our annual GDP. Globally, the combined stimulus is over $30 trillion or 35% of combined GDP (Figure 2). As we have not seen a stimulus of this magnitude previously, experts can only make educated guesses at to the future outcome. The risk of unintended consequences is high.

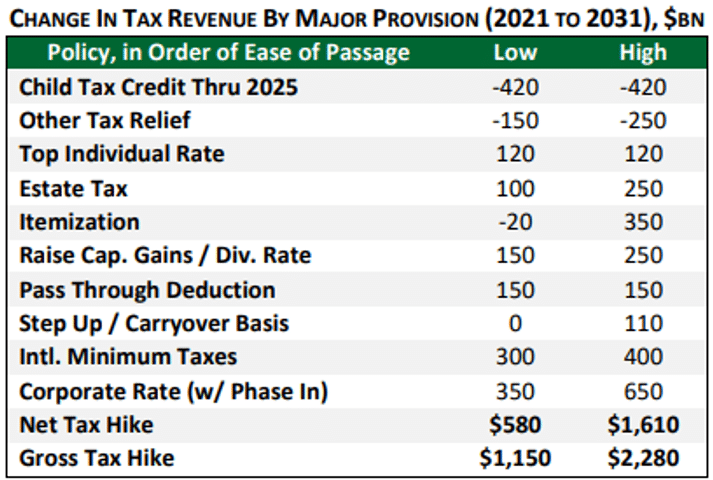

The Biden Administration is targeting $2 to $4 trillion in further spending in 2021 on infrastructure, climate change and other Democrat priorities. To partially fund this large expenditure, the Administration is proposing raising taxes on higher-income individuals, corporations and investors via higher capital gains and dividend taxes. The total tax increase could be in the $1 to $2 trillion range (Figure 3). The debt ceiling will need to be raised and moderate Democrats will need to acquiesce to substantially higher budget deficits.

The fiscal stimulus in the U.S. post-COVID could total between $7-9 trillion, which has the potential of overheating the economy and causing inflation and interest rates to spike higher.

MONETARY POLICY

At the same time, the Federal Reserve’s forward guidance is to keep policy rates (federal funds) at zero thru 2023 and continue to purchase bonds at a rate of $120 billion a month until full employment is reached and inflation averages over 2% for some period. The Fed expects this dual strategy to stay in place until late 2022 and possibly into 2023. The Fed is not focused on its own inflation forecasts but instead actual realized inflation, which remains tame below 2%. In sum, the Fed is focused on increasing employment in 2021 and not recent spikes in inflation that they view as transitory. The Fed is letting the economy run hot, which risks an outbreak in inflation expectations. Money supply is growing over 25% a year and creating a flood of liquidity supporting the economy and markets.

ECONOMIC GROWTH & VALUATIONS

As we look across the global economy, we see evidence of rising estimates of economic growth as vaccination rates improve, the economy reopens and another massive fiscal stimulus of $1.9 trillion is deployed. The U.S. economy may grow in the 7-9% range in 2021, the highest rate of growth since the early 1980s. While output is still 2.5% below the pre-Covid 4Q 2019 level, real GDP is on track to exceed the pre-Covid level in the second half of 2021, which is earlier than previously expected.

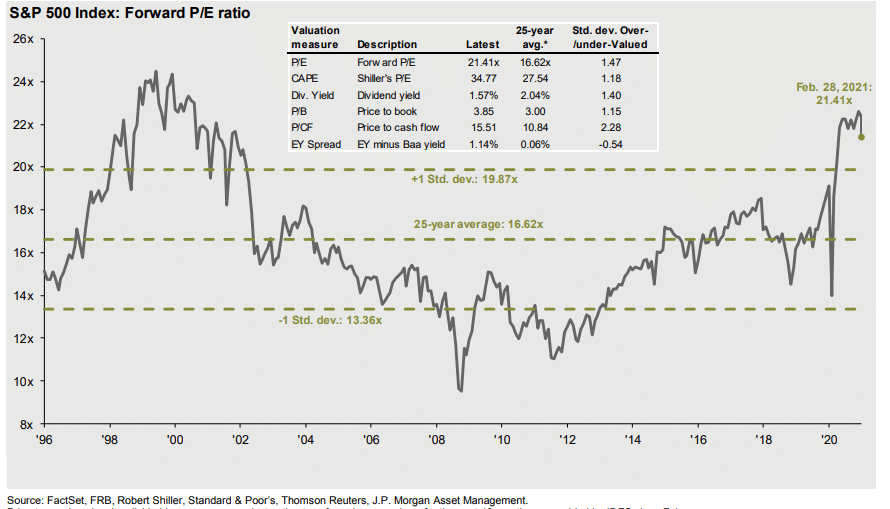

S&P 500 corporate earnings estimates for 2021 continue to move higher to $176 in 2021, up 25% from $140 in 2020. This results in a forward operating price-earnings multiple of 22 times earnings. Valuations are at 11-year highs. Professor Shiller’s and Warren Buffett’s favorite valuation measures, the CAPE ratio and the stock market capitalization to GDP ratio, are both at historic high levels (Figure 4). With valuations stretched, earnings growth will be the key to driving stock prices higher going forward.

INTEREST RATES AND INFLATION

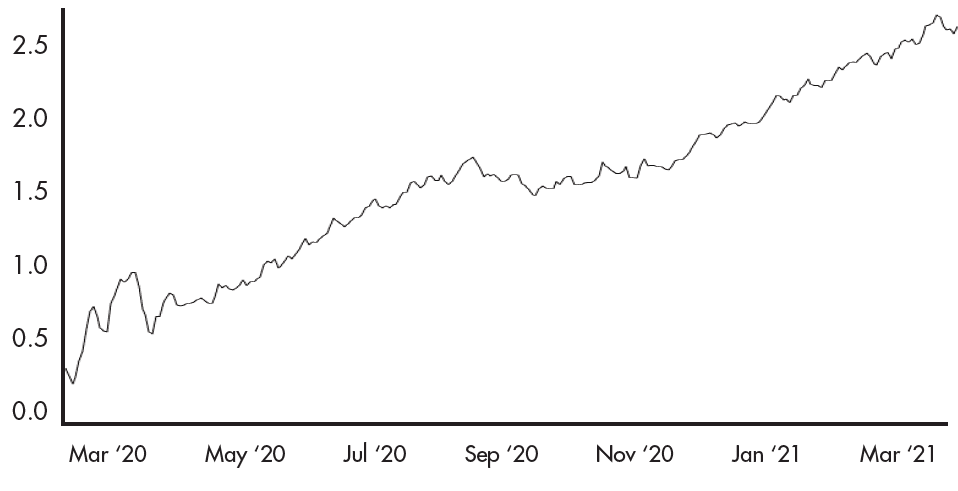

The recent rise in Treasury yields is pressuring global risk assets. The 10-Year Treasury yield recently rose to 1.74%, which is up from its low of 0.50% in mid-2020. With the Fed holding the short-term policy rate at zero, the yield curve has steepened from one to 30 years. The rise in bond yields is being led by rising real yields that remain in negative territory. Inflation expectations have spiked to the highest level since October 2018 as 5-year breakeven inflation expectations broke above 2% (Figure 5). The Fed expects the rise in inflation to be transitory and has signaled it will not preemptively tighten interest rates based on future inflation forecasts. Investors are less convinced that inflation will remain contained. A key to markets in 2021 will be whether the 10-Year interest rate rises slowly or in a disorderly fashion. Based on historical models, the 10-Year Treasury yield would be 4% or more based on current economic data. Investors will also be looking for the Fed’s guidance on potential tapering of bond purchases. The Fed is committed to keeping interest rates low to support the economy. Regardless of the Fed’s actions, the direction of bond yields is clearly higher over the next few years.

COVID-19

There is good news on the virus front as cases, hospitalizations and deaths have plunged. The vaccination rollout is accelerating. 20% of the U.S. population has started the vaccination process and nearly 10% of the population is fully vaccinated. At the current rate, 75% of Americans could be vaccinated by August, which is faster than previous estimates. This is contributing to rising economic growth rates. Risks includes new virus strains like those in Europe that have begun to appear in the U.S. that could cause another wave and lower efficacy rates of the current vaccines, prompting a slower recovery.

LOOKING FORWARD

Looking out over the next 6-12 months, our base case is as vaccines rates accelerate towards the level for herd immunity, the global restart will gain momentum and lead to strong global growth over the balance of 2021. The strength of the recovery will be led by massive monetary and fiscal stimulus, rising vaccinations and pent-up demand. On a tactical basis, we have a pro-growth stance and are overweight equities and underweight fixed income. We have inflation-linked bonds and precious metals for inflation protection and diversification. In navigating the landscape, our focus is building balanced portfolios that are well-diversified, resilient and quality focused.

INVESTMENT IMPLICATIONS: PORTFOLIO POSITIONING

Our base case view over the next 12 months is for a reacceleration in global growth as the vaccine-led restart gains traction, central banks maintain low interest rates and governments provide additional fiscal support. This leads us to a pro-growth stance emphasizing tactical allocation across geographies, markets and sectors. Our focus is on building portfolios that have a quality bias, are resilient and well-diversified.

We have a pro-growth stance on risk assets as massive stimulus and vaccines enable a broad global restart. Tactically, we maintain an overweight to large cap U.S. equities, coupled with an overweight to inflation-linked bonds and gold. Portfolio diversifiers are important in hedging downside risks in portfolios. High quality U.S. bonds provide balance to equity risk in portfolios. Inflation-linked bonds and gold provide a hedge to a future inflation surprise due to excessive monetary creation.

We have short-term fixed income investments for dry powder to take advantage of opportunities.

In equities, we maintain a pro-risk tilt as the economy reopens, despite elevated valuations. Tactically, we are overweight equities as the restart and low rates support the recovery. We are overweight large cap U.S. equities (due to strong competitive positions, cash flows and dividends) and tilt toward emerging markets. We have increased allocations to small/mid-cap and emerging markets where exposure to cyclicality will benefit from a vaccine-led restart. We are underweight international equities and Europe. With a weaker dollar and lower valuations overseas, we have increased our overall non-U.S. exposure.

In fixed income, we expect interest rates to have an upward bias in the intermediate/long part of the yield curve due to fiscal stimulus and a broadening recovery. We prefer U.S. investment grade bonds that have relatively higher yields, providing greater ballast for portfolios to hedge equity risk and have a Fed policy backstop. We prefer and are overweight inflation-linked bonds (TIPS) that are high quality assets providing a hedge against rising inflation expectations. We have upgraded the credit sector with allocations to floating rate loans, high yield and emerging market debt that have higher yields and benefit from the vaccine-led recovery.

We continue to incorporate diverse asset classes including gold, short-term investments, investment grade bonds, alternatives and cash that act as portfolio diversifiers and provide liquidity. We have an allocation to gold that is an effective equity hedge against financial uncertainty and the printing of money.

In an environment with record low interest rates and increased valuations, forward looking asset class returns are lower than historical averages. We expect continued volatility over the near term due to the potential additional virus waves, spikes in inflation, and rising interest rates. Overall, our dynamic tactical asset allocation continues to enhance returns and reduce risk.

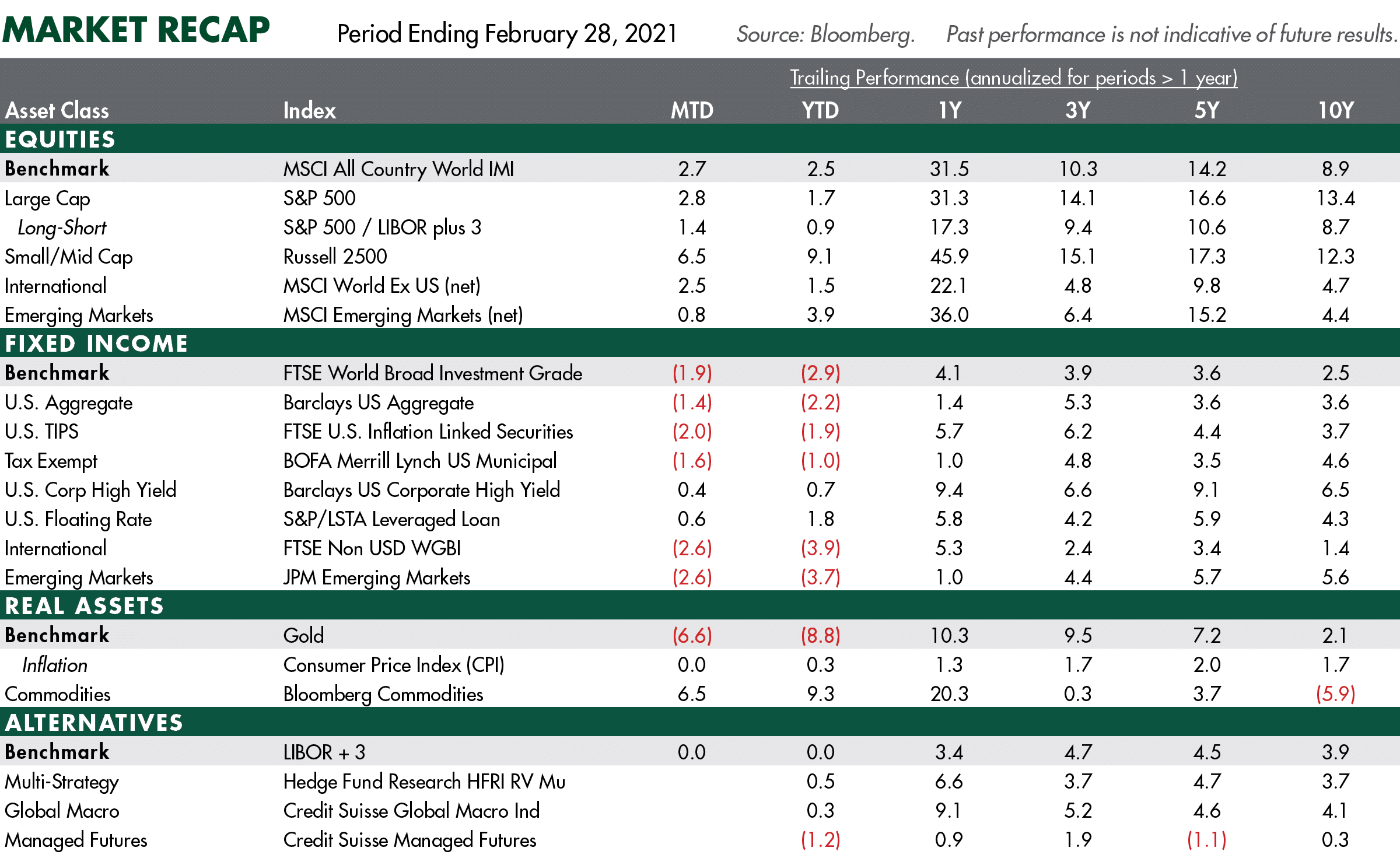

MARKET RECAP (FEBRUARY 28, 2021):

- Equity markets have started the year with gains as U.S. equities hit another record high before easing at month end as interest rates rose. The MSCI All Country World Index (ACWI) gained 2.5% and S&P 500 rose 1.7%. Small caps and emerging markets were the clear leaders gaining 11.6% and 3.9%, respectively.

- In terms of investing styles, growth outperformed value by a wide margin in 2020. For the first eight months of 2020, U.S., large-cap and growth stocks outperformed International, small-cap and value stocks. Since last September, the latter group has outperformed.

- In fixed income, the yield on the 10-Yr, U.S. Treasury spiked from a low of 0.50% last year to 1.41%. Year-to-date, global bonds fell 2.9% and the Barclays Aggregate Bond Index declined 2.2%. The credit sector had positive returns with floating rate loans and high yield returns gaining 1.8% and 0.7%, respectively.

- Gold declined by 8.8% as interest rates rose and bitcoin attracted demand. WTI oil prices have been strong rebounding to $62 per barrel. Commodities gained 9.3% as prices are rising due to the economic restart.

- Alternatives have benefitted from higher interest rates and volatility.