May saw markets rebound as tech and consumer stocks surged, offsetting bond losses and debt concerns. International equities outpaced U.S. gains, while gold cooled but remained a top performer.

by Greg Berg, CFA, CAIA, MBA, Senior Vice President & Senior Portfolio Manager

INVESTMENT OUTLOOK

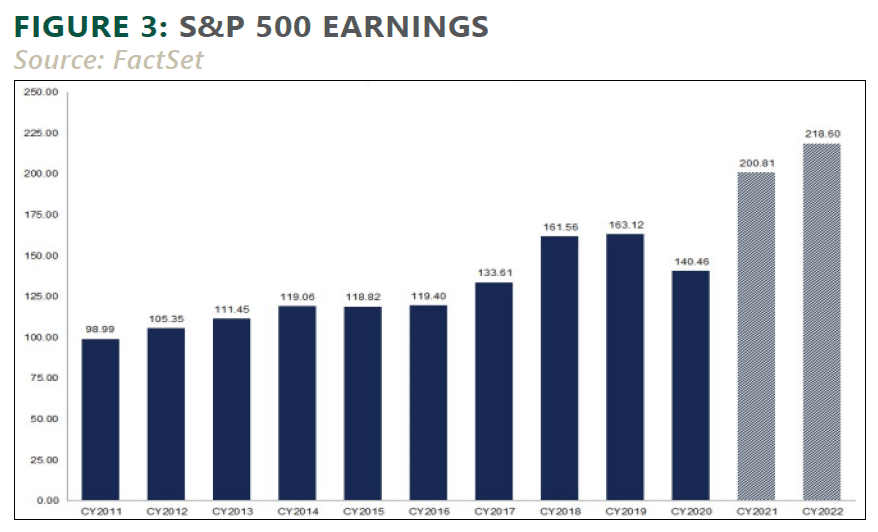

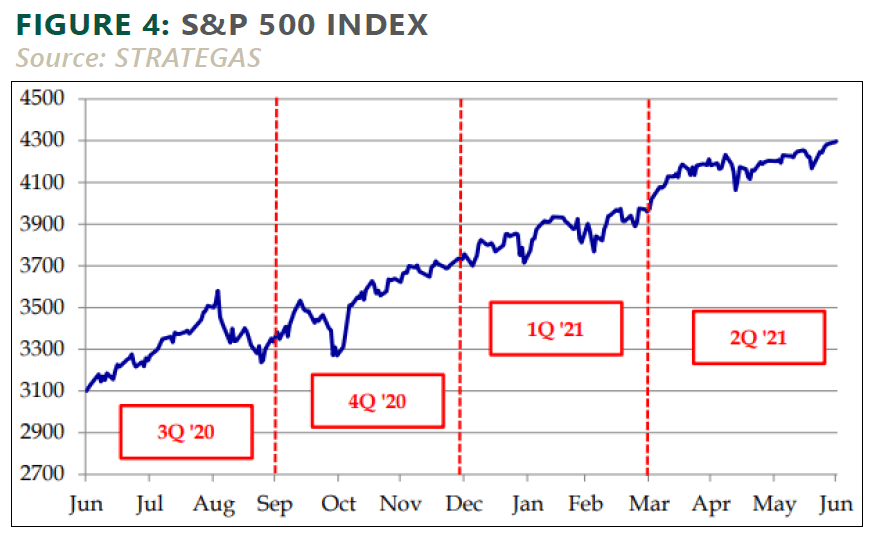

Global stock markets continued to appreciate during August, extending gains since March 2020, driven by low interest rates, the successful vaccine roll-out, and unprecedented stimulus. The S&P 500 marked its seventh consecutive monthly gain reaching an all-time high. Economic and earnings growth have soared in 2021 due to the global reopening, healthy consumer balance sheets, pent-up demand, and massive fiscal and monetary stimulus. The economy is now in mid-cycle following a peak in growth, inflation and stimulus. Valuations are elevated and near record highs, trading at 21.5 times forward operating earnings, compared to its 16.7 times average for the last 25 years. We expect markets to be choppy into year-end as valuations remain high and growth slows.

HIGHLIGHTS

The economy has now exceeded its pre-pandemic level and moved from early cycle to mid-cycle. The global economy is growing above-trend going into 2022.

Expectations are the Fed will announce tapering in September/October that would start in early 2022, followed by the lifting of short-term rates in 2023.

Major risks medium-term include rising deficits to WWII levels, record debt levels, and a potential fall in the U.S. Dollar.

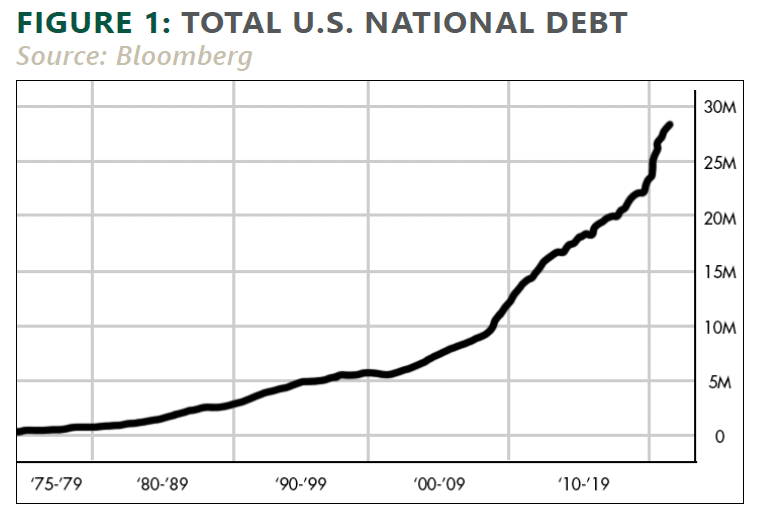

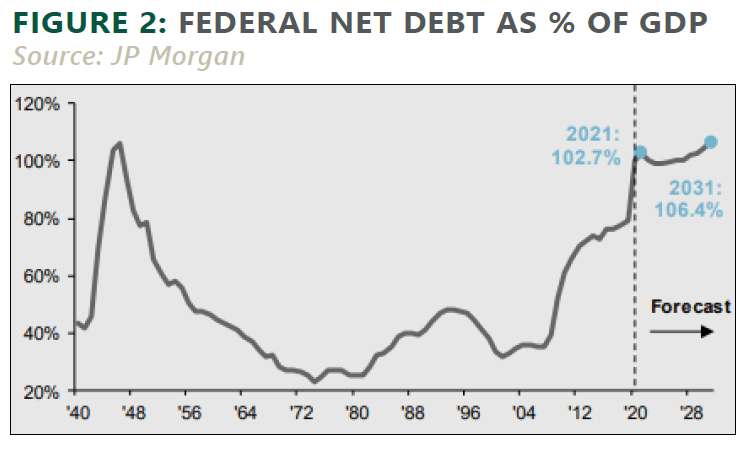

RECORD DEFICITS, DEBT, AND THE DOLLAR

The current investment landscape is highly unique in the annals of investment history. The Federal Reserve and Congress continue to provide extreme levels of stimulus during a period of robust economic growth, the fastest in 35 years. As the spending is not paid for with higher taxes, deficits have exploded since 2020. Federal debt will increase $3 trillion in 2021, pushing total Federal debt to $29 trillion (Figure 1), a troubling 102.7% of annual GDP that will soon hit a new  record high eclipsing World War II levels (Figure 2). The Federal Reserve is monetizing the deficits by expanding its balance sheet and printing money, which is encouraging even higher spending by Congress. This trend is coincident with the rise in Modern Monetary Theory (MMT), whose tenets are that deficits and debt don’t matter if the country has a reserve currency.

record high eclipsing World War II levels (Figure 2). The Federal Reserve is monetizing the deficits by expanding its balance sheet and printing money, which is encouraging even higher spending by Congress. This trend is coincident with the rise in Modern Monetary Theory (MMT), whose tenets are that deficits and debt don’t matter if the country has a reserve currency.

A major risk of MMT policies is that foreign investors’ appetite for buying U.S. Treasury debt declines, causing upward pressure on interest rates, lower demand for U.S. dollars, and a sharp drop in the value of the dollar. In the short-term, a declining dollar would cause inflation to rise. Longer term, the major risk is that the U.S. dollar could lose its status as the world’s reserve currency, which would have major negative ramifications for the U.S.

Another consequence of high debt levels is financial repression. Rapidly expanding debt levels are requiring financial repression by the Fed in keeping interest rates artificially low to prevent the interest costs on the debt from consuming too large of a portion of the budget. It’s hard to believe there will not be negative consequences from this mixture of policies in the future.

ECONOMIC GROWTH

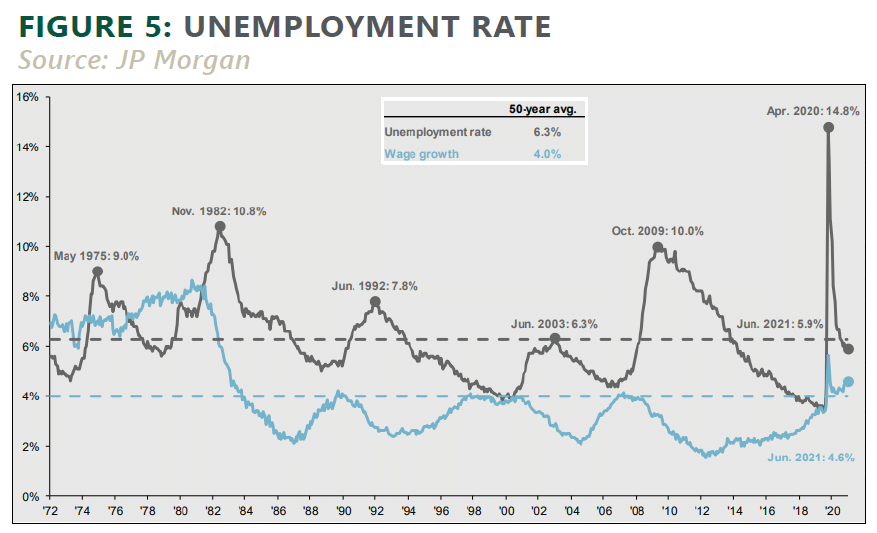

The economy has boomed with U.S. GDP growth likely to grow over 7% in 2021, the fastest economic growth in the past 35 years. The economy has now exceeded its pre-pandemic level and moved from early cycle to mid-cycle. Corporate earnings have continued to surprise to the upside, on track to grow over 40% in 2021 (Figure 3). The rebound in the economy and stock market (Figure 4), from last year has been robust.  The unemployment rate has dropped from 14.8% to 5.4% in 15 months (Figure 5), which is four times faster than a typical recovery. However, the economy still has nine million less jobs than before the pandemic.

The unemployment rate has dropped from 14.8% to 5.4% in 15 months (Figure 5), which is four times faster than a typical recovery. However, the economy still has nine million less jobs than before the pandemic.

The U.S. has led the global restart. Other developed markets are earlier in the cycle and likely to see their growth begin to pick up as  vaccination rates accelerate and economies reopen. Recently, signs of slowing include a slowdown in China, disappointing U.S. retail sales, and a sharp drop in consumer sentiment.

vaccination rates accelerate and economies reopen. Recently, signs of slowing include a slowdown in China, disappointing U.S. retail sales, and a sharp drop in consumer sentiment.

INFLATION & INTEREST RATES

The economic restart has caused a sharp spike in inflation. CPI inflation jumped to 5.4% year-over-year, which is above the Fed’s 2% long-term goal and the long-term average of 3.7% over the last 60 years. With recent inflation readings far above expectations, the Fed’s stance is that the spike in inflation is transitory, driven by supply bottlenecks and temporary spikes in commodity/energy costs. In the short-term, inflation will moderate as pent-up demand is satisfied from the reopening. The long-term inflation outlook is likely to be above pre-pandemic levels due to the move away from global supply chains, the switch from fossil fuels to green energy, and higher wages required to retain a diminishing demographic pool of workers.

Despite higher inflation, the bond market seems to not be overly concerned, as the 10-Yr U.S. Treasury yield has fallen from a peak of 1.74% in March to 1.37%, currently. Real interest rates continue to be significantly negative, which is positive for risk assets. The bond market may be signaling slower future growth as we reach peak growth in GDP, earnings, and stimulus.

MONETARY POLICY

The Fed has started to discuss how and when to begin tapering while emphasizing continued risks from Covid, and that more progress is needed toward achieving full employment. Currently, the market is expecting the Fed to announce tapering in September/October that would start in early 2022, followed by the lifting of short-term rates in 2023.

Economic growth turned positive last summer from the Fed’s actions and accelerated with the vaccine rollout. Yet, the Fed remains highly accommodative as it continues to hold short-term interest rates near zero and continues to buy $120 billion in securities a month. The Fed’s balance sheet has ballooned from $800 billion pre-pandemic to $4 trillion. The Fed is clearly focused on reducing unemployment further even though inflation is spiking, which could lead to higher interest rates that would negatively affect the economy. With higher inflation and lower growth, the economy might enter a stagflation period that would be a headwind for equity and fixed income markets.

FISCAL POLICY

Since the pandemic started in early 2020, fiscal stimulus has been massive with over $5 trillion in spending by Congress that dwarfs the $800 billion package approved during the Great Financial Crisis. The U.S. Senate approved a $1.2 trillion infrastructure bill that awaits a vote in the House that has $550 billion in new funding for public transit, roads and bridges, and physical infrastructure. The Biden Administration is proposing an additional $3.5 trillion in spending on healthcare, child/elder care, climate change, and other Democrat priorities that would have to be passed unilaterally via reconciliation. To fund these outlays, the Administration is proposing higher taxes on corporations and higher-income individuals. Current thinking (highly fluid) is a bill will likely pass in the Fall with $1.5-$2.0 trillion in new spending and $1.0-$1.5 trillion in new taxes to keep budget deficits within limits imposed by the reconciliation process. The uncertainty around higher future taxes may potentially pressure equity markets.

RISKS

The recent spike in cases from the delta variant and CDC data showing vaccinated individuals being re-infected and able to spread the virus creates the risk of new economic restrictions. Growth is peaking and beginning to slow. Stock market valuations are elevated indicating lower returns and higher potential risk. The trend in yields is likely higher over the next few years.

LOOKING FORWARD

Our base case view over the next 6-12 months is for a broadening of global growth as the vaccine-led restart gains traction, central banks maintain low interest rates, and governments provide historically massive fiscal support. We continue with a pro-growth stance, emphasizing tactical allocation across geographies, markets, and sectors. Global growth will be above-trend this year and into the beginning of 2022. This will provide additional support to global stock markets. In navigating the landscape, our focus is on building portfolios that have a quality bias, are resilient and well-diversified.

INVESTMENT IMPLICATIONS: PORTFOLIO POSITIONING

While we remain constructive on risk assets as massive stimulus and vaccines drive above trend growth, we expect further gains to be more muted and nuanced. On a tactical basis, we maintain an overweight to equities and an underweight to government bonds and cash. Portfolio diversifiers are important in hedging downside risks. High quality U.S. bonds provide balance to equity risk in portfolios. Inflation-linked bonds and gold provide a hedge to a future inflation surprise due to excessive monetary creation. Shorter-term fixed income investments minimize risk of rising yields and act as dry powder to take advantage of opportunities.

In equities, we maintain a pro-growth tilt as the economy transitions to a mid-cycle expansion, despite stretched valuations. Tactically, we are overweight to equities and cyclical regions/sectors as global growth broadens out. We are overweight to large cap U.S. equities and tilt toward small/mid-cap and international markets for cyclicality that benefit from accelerating global growth. With prospects for a lower dollar and less expensive valuations overseas, we have increased our non-U.S. exposure.

In fixed income, we keep duration below benchmark as we expect interest rates to have an upward bias in the intermediate/long part of the yield curve due to fiscal stimulus, deficits, and a broadening recovery. We prefer U.S. investment grade bonds that have relatively higher yields, providing greater ballast for portfolios to hedge equity risk and have a Fed policy backstop. We have been overweight inflation-linked bonds (TIPS) that are high quality assets providing a hedge against rising inflation expectations. We have an allocation to the credit sector including floating rate loans, high yield and emerging market debt that have higher yields and benefit from rising global growth. With spreads now near historical tight levels, we are neutral on the credit sector.

We continue to incorporate diverse asset classes including gold, short-term investments, investment grade bonds, alternatives, and cash that act as portfolio diversifiers and provide liquidity. We have an allocation to gold that is an effective equity hedge against financial uncertainty and the printing of money.

In an environment with near record low interest rates and stretched valuations, forward looking asset class returns are lower than historical averages. We see the potential for higher volatility through year-end due to the new Covid variant, spikes in inflation/interest rates, and uncertainties around the Administration’s tax plan. Overall, our dynamic tactical asset allocation continues to enhance returns and reduce risk.

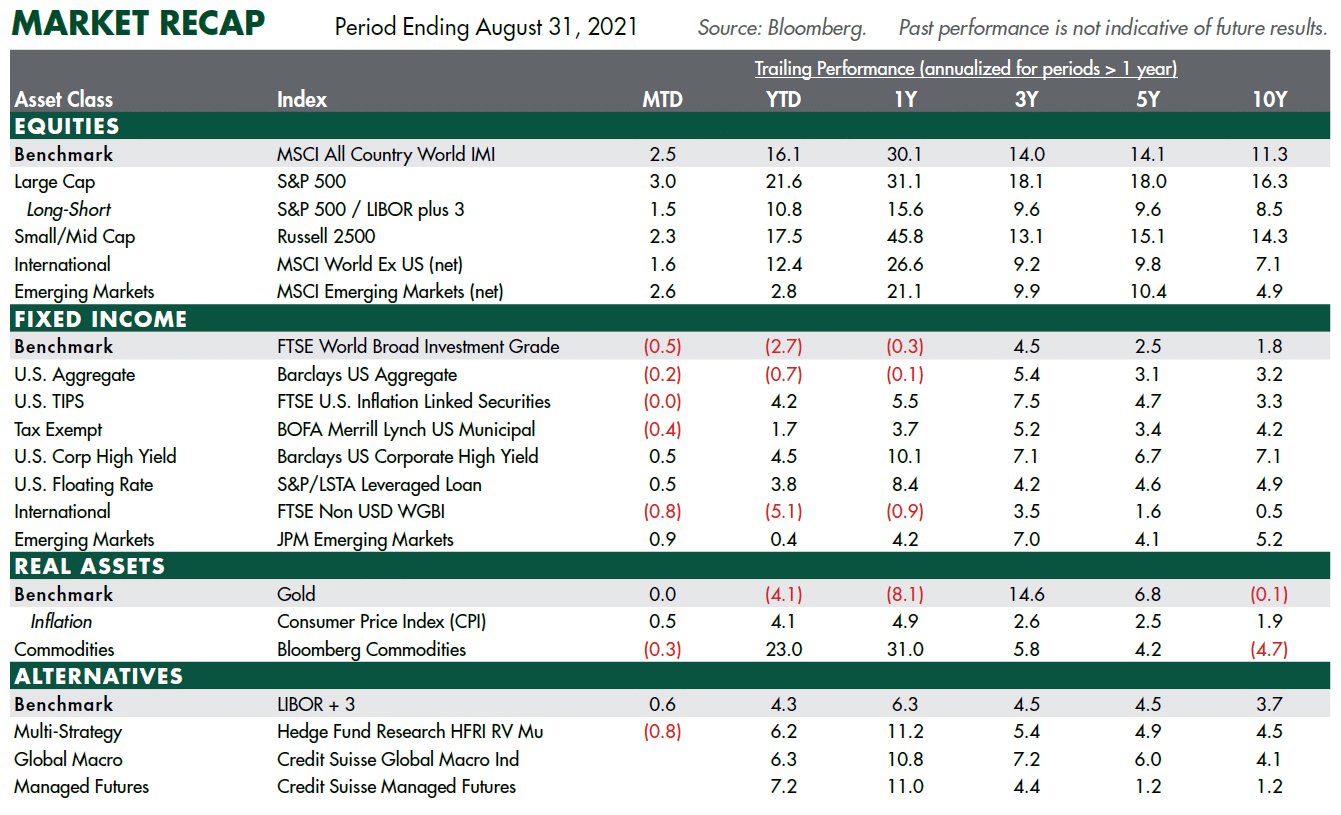

MARKET RECAP (AUGUST 31, 2021):

- Year-to-date, global equity markets have soared, while the global bond market has had negative returns as interest rates rose. Global equity markets gained 16.1% and global fixed income fell 2.7% in 2021. In August, U.S. equities led global markets reaching another record high as the S&P 500 gained 3.0%. Year-to-date, International Developed equities rose 12.4%, while Emerging Markets are up 2.8% lagging due to weakness in China from its regulatory crackdown.

- In terms of investing styles, value outperformed growth early in the year and is now in-line with growth. Small-cap and mid-cap outperformed large cap stocks early in the year and are now trailing large-cap.

- In fixed income, the yield on the 10-Yr. U.S. Treasury spiked from a low of 0.34% last year to 1.7%, before a recent sharp decline to 1.37%. Year-to-date, global bonds fell 2.7% and the Barclays Aggregate Bond Index declined 0.7%. The credit sector outperformed with positive returns as spreads tightened with gains in floating rate loans and a high yield of 3.8% and 4.5%, respectively.

- Gold struggled after a strong 2020 and was lower by 4% year-to-date. WTI oil prices have soared 50% to $68 per barrel. Commodities gained 23% due to supply bottlenecks and pent-up demand. Alternatives benefitted from higher interest rates and volatility posting gains of 2-7%.