May saw markets rebound as tech and consumer stocks surged, offsetting bond losses and debt concerns. International equities outpaced U.S. gains, while gold cooled but remained a top performer.

By Charles Welsh – Wealth Management Advisor and Ken Frevert, MBA, AMWA® – Senior Vice President & Senior Portfolio Manager; Kansas City Location Manager

Most of us understand and recognize inflation. We experience inflation when we fill up our cars, shop for groceries or make more substantive purchases such as appliances, electronics, and automobiles. We also have heard about some of the reasons for inflation:

- Supply chain issues related to COVID-19

- Lack of skilled labor and “the great resignation”

- Government stimulus

- And the Fed’s extremely accommodative monetary policy.

While we know how to recognize inflation and what causes inflation, we don’t know how high it will go or how long it will last.

What Is the Predicted Inflation?

The Fed is predicting 2.6% inflation in 2022. This is the same Fed that told us to expect 4% inflation in 2021 and that it would be transitory (as supply chain issues were resolved). Most analysts expect 2022 inflation to remain higher than usual because of structural cost increases related to wages (and worker shortage), increasing energy demands, and higher housing costs from rents, home prices, and increasing interest rates.

How Does Inflation Work?

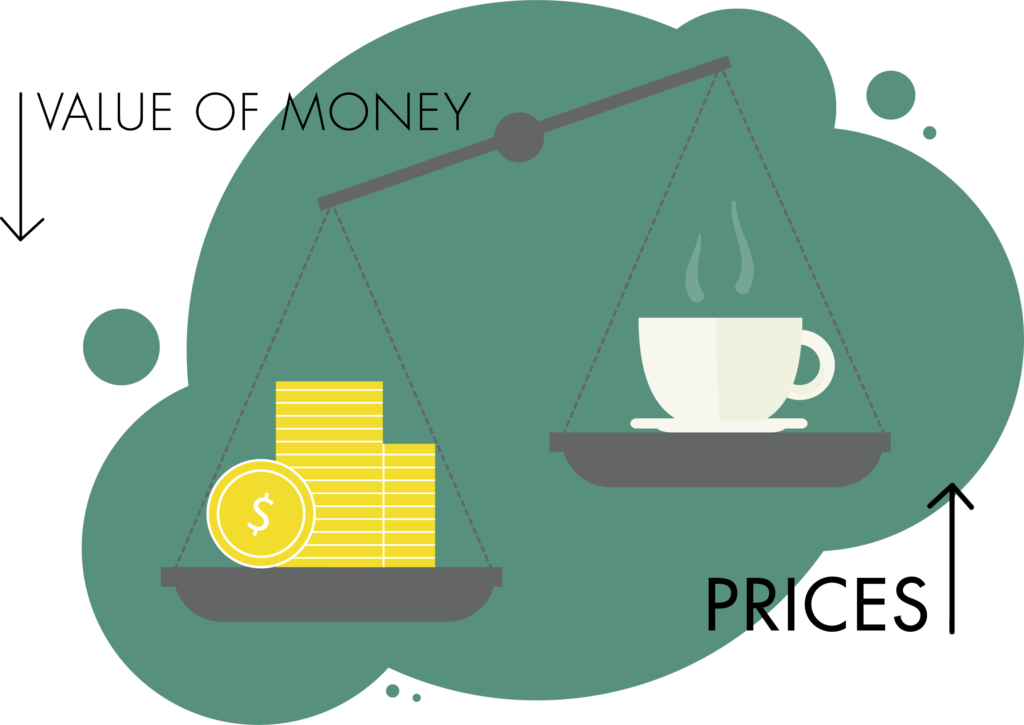

With prices going up on almost everything we buy, it may seem logical to reduce investment risk and, instead, raise cash. Unfortunately, inflation diminishes buying power with each passing month.

If you maintained a $100,000 savings account throughout 2021 your $100,000 now has the purchasing power of $93,000 (a decline of 7%) compared to one year ago. If the inflation that you experienced was even greater than 7% – your cash/purchasing power is worth even less.

Similar to cash, fixed-income investments such as bonds with long-term cash flows tend to perform poorly, thereby falling in value, when inflation is rising as the purchasing power of those cash flows falls over time. Additionally, long-term fixed investments are negatively impacted by the Fed’s increasing rates. For example, if you own a 10-year $1,000 bond paying a 3% coupon and the market interest rates rise to 4% in one year, the bond will still pay 3%, but the bond value would likely fall to $925.

What Happens If Inflation Keeps Going?

If inflation persists, consider investments designed to perform well during inflationary periods. This includes the following:

- Treasury Inflated-Protected Securities (or TIPS) are a type of U.S. Treasury security whose principal value is indexed to the rate of inflation. When inflation rises, the TIPS’ principal value is adjusted up. If there is deflation, the value is adjusted lower. TIPS are backed by the full faith and credit of the U.S. government.

- Infrastructure Commodities required for expanded internet and repairing roads and bridges will be in demand as our government allocates the $1.2B infrastructure bill.

- Value Stocks that have strong current cash flows and the ability to pass on higher prices to customers typically outperform during periods of high inflation.

- Financial Companies that benefit from higher interest rates.

- Gold has historically been used as a hedge against inflation.

Secure Your Finances With the Central Trust Company

While we don’t know how long inflation will last, we do know that it is diminishing the value of your cash. At Central Trust Company we manage portfolios to perform under a range of market environments. This includes customizing portfolios to the unique financial goals and risk tolerance of our clients. If you’d like to discuss additional options for a large cash position, please contact your Central Trust Company wealth advisor.