While elections can certainly be an emotional time, they are not the time to make drastic investment decisions based solely on election outcomes.

By Matthew Suarez – Vice President & Portfolio Manager

“History provides a crucial insight regarding market crises: they are inevitable, painful, and ultimately surmountable.” Shelby M.C. Davis

The past 15 months have shown us volatility that we have not experienced since the Great Financial Crisis in 2008 – 2009. With a combination of post pandemic inflation, war in Europe, talk of recession, and rising interest rates that haven’t been seen since the 1980’s, there is a lot of emotion to go around in the world of investing. While it is perfectly natural to have a range of feelings in markets like these, it is important that you don’t let fear of the market lead you to the biggest risk of all – not reaching your long-term financial goals. As the quote above teaches us, given enough time and the right investment strategy, any market crises can be overcome.

Generally speaking, investors are driven by two underlying emotions, fear, and greed. Both can be equally powerful as well as equally problematic. Fear can cause investors to act too rashly or impulsively, causing greater negative impact to a portfolio. Likewise, greed can cause an investor to fail to act when it is in their best interest.

One of the most impactful mistakes that investors can make when there is a rise in the turbulence of the markets is to regard the declines in their investments as “losses” rather than the natural ebb and flow of the market. These declines are only “losses” on paper and are not realized unless the investment is sold, or the allocation is shifted to a more conservative one. If the investments are held, then there is the likely potential that the investment will recover their lost value. As we learned in 2008, those that sold out of their investments close to the bottom took significantly longer to regain their principal than those who stayed the course.

There are a couple common pitfalls that investors should avoid during periods of market fluctuation in order to stay on track with their goals.

Loss Aversion

Loss aversion is when investors feel the pain of loss more than the joy of gain. A study on loss aversion conducted by Nobel Prize winner Daniel Kahneman and mathematical psychologist Amos Tversky illustrated that the average investor feels the pain of an investment losing value twice as much as the joy of that investment gaining value. Loss aversion can result in an investor selling too soon or changing the allocation of their portfolio at an inopportune time.

Selective Memory

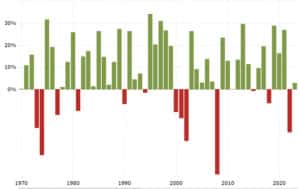

Another common pitfall that plagues investors during volatile market conditions is selective memory. This is the tendency to remember the years when the market was positive more so than the years when it was negative. This is especially important when we look at the stock market over the past few years. Last year the S&P 500 dropped 19%. However, this was preceded with three consecutive years where the market was up double digits: 29%, 16%, and 27% respectively.

S&P 500 Historical Annualized Returns

Source: Macrotrends.net

As can be seen from the above chart, negative years in the market are fairly commonplace. Every few years the market will have low performing or negative year, and this is all part of investing.

It can be an extremely difficult task keeping our emotions in check during times of increased market volatility. We are bombarded by news outlets, social media, and talking heads whose goal is generally not to educate and reassure, but to drive viewership. It is imperative that we are aware of our emotional biases when it comes to investing and always keep our long-term financial goals top of mind. This will help you navigate these unsure waters and to keep your financial course steady and true.