Learn the key differences between IRAs and 401(k)s, including tax benefits, contribution limits, and withdrawal rules to help you choose the right retirement plan for your financial goals.

For many people, saving for retirement starts out fairly simple. You contribute to a 401(k), maybe add to an IRA, and let the money grow. As income rises, however, contribution caps and income thresholds can phase out eligibility, making those options more limited.

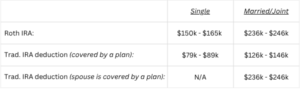

In 2025, for example, eligibility for Roth or deductible IRA contributions begins to phase out at the following Modified Adjusted Gross Income (MAGI) levels:

When your savings goals exceed standard retirement plan limits, it helps to know there are additional strategies available:

Non-Deductible Traditional IRA Contributions (“Back Door” ROTH Opportunity)

When income limits prevent you from making deductible IRA contributions, you can still contribute on a non-deductible basis. In 2025, the funding limit is $7,000 for those under 50 and $8,000 for those 50 or older. These after-tax contributions grow tax-deferred just like pre-tax contributions.

Because the contributions are non-deductible, your “basis” (the amount you contributed after-tax) comes out tax free. This creates the opportunity for the “backdoor Roth” strategy:

- First, make a non-deductible contribution to a traditional IRA.

- Then, convert that contribution to a Roth IRA, where future growth can be tax free.

When funds are withdrawn or converted, your after-tax contributions are combined with any other traditional, SEP, and SIMPLE IRA pre-tax balances and distributed on a pro-rata basis. This may reduce the effectiveness of the strategy.

Tip: If you already have pre-tax IRA balances, one option is to roll those into your 401(k). Doing so may help “clear the way” for more efficient backdoor Roth contributions going forward.

Non-Deductible 401(k) Contributions (“MEGA Backdoor ROTH” Opportunity)

Some 401(k) and 403(b) plans allow employees to make after-tax contributions beyond the standard annual deferral limits. For 2025, those limits are:

- Employee deferral limit: $23,500 (plus a $7,500 catch-up contribution if age 50 or older)

- Total contribution limit (employee + employer): $70,000 (plus catch-up contributions, if eligible)

- Additional catch-up provisions: Available for participants ages 60–63 and for 403(b) participants with 15 years of service at their organization.

These after-tax contributions can then be converted to Roth, similar to the backdoor Roth IRA strategy. However, unlike IRAs, the IRS does not require after-tax contributions in a 401(k) or 403(b) to be aggregated with pre-tax retirement balances. This may make the “mega backdoor Roth” a particularly effective way to expand tax-advantaged savings.

Tip: Check with your HR department or plan administrator to confirm whether your employer’s plan allows for after-tax contributions and in-plan conversions.

Non-Qualified Annuities

Non-qualified annuities have no contribution limits. You invest after-tax dollars, and earnings grow tax-deferred until they are withdrawn. These contracts can be beneficial for investors focused on income-producing assets or those who expect to be in a lower tax bracket in retirement. However, they also come with certain drawbacks:

- Liquidity: You must hold the annuity until at least age 59 ½, and beyond the surrender period to avoid tax and contract penalties.

- Tax Treatment: Policy gain must be withdrawn before after-tax contributions and is taxed as ordinary income.

- Beneficiaries: Contracts do not receive a “step-up in basis” at death.

Tip: Beneficiaries of some non-qualified annuity contracts may be able to use a lifetime stretch payout option—unlike inherited IRAs, which must now be emptied within 10 years.

Taxable Brokerage Accounts

Although income and realized gains are not tax-deferred, taxable brokerage accounts remain an excellent option for long-term savings.

- You receive preferential capital gains tax treatment on qualified dividends and sales of appreciated assets which are held for more than one year.

- Your heirs receive a step-up in basis at your death, which means unrealized (unsold) gains pass to your beneficiaries, tax free.

- You may optimize your tax situation by investing in tax-efficient funds and using strategies like tax-loss harvesting and donating appreciated securities to charity.

It is important when choosing the appropriate savings vehicle to consider your long-term goals, tax situation, and estate plan. These four options may help high earners extend their tax efficiency well beyond retirement plan limits. Be sure to consult with your Central Trust Team, tax advisor, or retirement plan professional to understand what options may be best for you.