Wealth Perspectives Newsletter

This semi-annual client newsletter is your guide to general investment news, wealth and estate planning articles, and much more.

Unpredictable • Legislative Potpourri: An Update on Tax Legislation • Estate Planning for Executives • How Upcoming Legislation Might Impact Retirement Plans • Health Savings Accounts: Connecting Health & Wealth • Don't Call it a Comeback...

Wealth Perspectives Spring 2022

Wealth Perspectives Spring 2022

Latest Articles

While no one can predict the future, the dollar is still the most dominant reserve currency in the world. Learn about its impact on global economics, alternatives, and potential scenarios in this insightful analysis.

Markets heated up in January as stocks, global equities, and precious metals rallied while AI spending, Federal Reserve uncertainty, and volatility raised caution.

Investors closed out 2025 with strong returns, but not without growing unease. A weak Santa Claus rally, rising valuation concerns, and signs of AI fatigue drove sector rotation and shifting global opportunities as markets look toward an uncertain 2026.

For automotive enthusiasts, collectible vehicles often reflect a deep sense of history and personal legacy. From classic muscle cars to modern performance icons, thoughtful estate planning helps ensure these prized assets are protected, properly valued, and passed on according to your wishes.

A season-by-season financial planning framework helps individuals maintain clarity and confidence as their financial strategy evolves throughout the year.

Thoughtful estate planning for collections protects a lifetime of passion, helping families navigate inheritance, trusts, charitable giving, and long-term legacy goals.

It's important to be prepared if you want your family business to survive the passing of generations.

November saw a decisive bullish rebound, with stocks, bonds, and precious metals surging despite economic uncertainty. Discover what fueled the comeback and what it means for investors.

Optimize your finances with our year-end checklist. Review tax strategies, legacy plans, and charitable giving to stay on track for 2026.

Start 2026 strong with actionable wealth management goals: optimize investments, increase savings, and plan your legacy for future success.

Discover how nonprofit financial stewardship, strategic investment planning, and tax-efficient wealth management help organizations align investments with mission and achieve long-term sustainability.

Learn the power of Donor Advised Funds (DAFs) for tax-efficient and impactful giving. Enjoy immediate deductions, strategic contribution timing, privacy, and tax-free growth, making them a streamlined choice for meaningful philanthropy.

Markets rallied in October as technology and AI led gains. Explore how innovation, global shifts, and Fed policy are shaping today’s investment landscape.

As income grows, traditional retirement plans may fall short. Learn how backdoor Roths, after-tax 401(k) contributions, and annuities can help extend your tax-efficient savings.

Broad investment gains across stocks, bonds, and precious metals reflected market strength in September, driven by AI growth, interest rate cuts, and resilient global performance.

A clear explanation of the estate settlement process, including probate, executor duties, asset distribution, tax obligations, and the role corporate fiduciaries play in managing complex estates with professionalism and accountability.

August delivered impressive gains across stocks, bonds, and precious metals. Uncover how Fed rate cut signals, tariff rulings, and strong sector earnings influenced market performance and what investors should watch for in September.

Markets were watching closely for signals on the path of policy during Jerome Powell's final Jackson Hole speech on Friday, August 22, 2025.

Estate planning for pet owners includes more than just a will. Learn how pet trusts offer lasting protection, enforceable care instructions, and peace of mind for your beloved animals.

Innovation in automotive, aerospace, manufacturing, and energy is reshaping the economy. Understanding these trends helps investors identify opportunities and manage risk with confidence.

U.S. stocks hit record highs in July before momentum faded amid rising inflation and tariff concerns. Explore key market movers, Fed policy debates, and why precious metals continue to shine.

How a financial advisor gets paid can influence the advice you receive. Knowing the difference between commission, fee based, and fee only models helps you make informed and confident financial decisions.

The Federal Reserve plays a central role in the U.S. economy through interest rate policy, inflation management, and market influence, while its independence from government ensures credibility and long-term stability.

Uncover the modern role of prenuptial agreements in financial planning and estate management. See how these agreements foster transparency, protect assets, and promote financial harmony in marriage.

The “One Big Beautiful Bill,” recently signed into law, reshapes U.S. tax policy by locking in TCJA provisions and introducing new deductions, credits, and savings incentives for families, seniors, and businesses, while phasing out green energy tax breaks and increasing the SALT cap.

June marked a second consecutive month of market gains as tech stocks led the rally, inflation cooled, and the Fed signaled a potential shift in policy.

May saw markets rebound as tech and consumer stocks surged, offsetting bond losses and debt concerns. International equities outpaced U.S. gains, while gold cooled but remained a top performer.

Learn the key differences between IRAs and 401(k)s, including tax benefits, contribution limits, and withdrawal rules to help you choose the right retirement plan for your financial goals.

April brought renewed market swings as tariffs and tumbling oil prices rattled investors. While energy lagged, tech and international stocks helped offset broader weakness, with gold gaining on safe-haven demand.

A financial crisis in the auto industry highlighted the need for stronger retirement protections, ultimately contributing to the creation and evolution of Individual Retirement Arrangements.

Preparing heirs to manage wealth requires early financial education, open family communication, hands-on experience, mentorship, and a strong focus on philanthropy to build long-term financial responsibility and purpose.

Value vs. growth investing explained through the lens of the P/E ratio, highlighting core differences, common risks, and how a fundamentals-driven, balanced portfolio can support long-term financial goals.

The Great Wealth Transfer is underway. Discover strategies like trusts, tax planning, and heir education to help preserve generational wealth for decades to come.

Markets declined sharply in March as rising tariffs, inflation concerns, and global unrest fueled widespread volatility. Investors turned defensive, with energy and precious metals leading performance amid heightened caution.

Build a tax-efficient healthcare fund with an HSA, offering triple tax advantages and lasting savings. 2025 limits, rules, and smart strategies explained.

Recent headlines regarding tariffs have captured significant attention and financial markets have responded decisively to these announcements.

Fair value goes beyond market price and is often determined using key valuation metrics like P/E ratio, ROE, and DCF, along with factors like growth potential and investor sentiment.

Is a trust or outright inheritance right for your family? Explore essential estate planning strategies, protect your assets, and secure your heirs’ futures.

In times of market uncertainty, it is natural to feel uneasy about your investments. As…

Filing a tax extension can be a smart financial move, especially for individuals with complex…

February brought market volatility as trade tensions, layoffs, and inflation concerns grew. Some sectors held strong, but uncertainty looms. Is stagflation ahead?

Learn key tax implications, from estate and income taxes to capital gains, to make informed financial decisions as the heir to a trust.

January kicked off 2025 with market highs, AI-driven volatility, and rising tariff tensions. While investors navigated uncertainty, strong earnings and safe-haven demand shaped the month’s outlook.

Secure your family's farmland with trusts, gifting strategies, and tax-efficient estate planning to preserve your legacy for future generations.

Learn about the Missouri Long-Term Dignity Account, a tax-advantaged savings plan helping residents save for long-term care with flexibility and state tax benefits.

December brought a rocky close to 2024, with markets facing challenges but maintaining resilience. Optimism around AI advancements, rate cuts, and election outcomes kept investors focused on opportunities ahead.

Preserve cherished family vacation spots with a solid estate plan. Discover key strategies for ownership structures, heir management, and location-specific laws.

Teach the value of saving, investing, and financial planning. Honor your family's financial legacy by giving the gift of financial literacy!

From establishing a family trust to charitable giving, learn how to pass down family values and start a family wealth tradition.

November brought plenty for investors to celebrate, with strong S&P 500 gains driven by Fed rate cuts and election outcomes.

As tax laws evolve, so should your financial strategies. Effective tax planning can help you maximize deductions, support your charitable goals, and reduce your overall tax burden.

Explore tips for discussing inheritance, succession planning, and financial goals with respect and transparency during holiday gatherings.

Understand how Federal Reserve rate cuts impact stocks, bonds, and gold, and learn how historical trends can guide investment strategies during monetary easing.

October markets started strong but ended with volatility driven by AI concerns, small-cap losses, and global pressures, while precious metals held steady.

Placing your home in a trust can help you avoid probate, ensure privacy, protect against incapacity, and optimize tax strategies for long-term peace of mind.

Discover why working with a financial advisor can enhance your long-term returns, improve asset allocation, reduce emotional investing mistakes, and help secure your financial future.

In today’s digital world, almost everyone has online accounts. Have you thought about what will happen to these assets when you're gone?

September brought market resilience amid volatility, with the S&P 500 rising and emerging markets outperforming, driven by economic shifts and global events.

August's market volatility, driven by tech stock concerns and economic uncertainty, has investors bracing for rate cuts and geopolitical risks ahead of election season.

Master financial planning to align your business and personal goals, ensuring long-term success and financial health for your company.

Discover how the Tortoise and the Hare fable reveals the critical importance of diversification in building and preserving long-term wealth.

Ensure your estate plan addresses every detail, including your personal belongings. This guide outlines the pros and cons of various methods for managing assets like household goods, jewelry, and collectibles.

Amid global focus on the Paris Olympic Games, July saw the S&P 500's positive returns for the third consecutive month, despite economic challenges and market volatility.

Remember when China was the growth engine of the world? For decades the question wasn’t if, but when the Chinese economy would surpass the US. But, is China's economic miracle over?

Secure your family's future with tailored estate planning. Trusts, wills, and durable powers of attorney are essential for protecting your loved ones and addressing unique challenges.

Many individuals believe that estate planning is only for the very wealthy and required to save on estate taxes. However, an estate plan can be so much more.

Thinking of rolling over your 401(k) or IRA? Discover the crucial IRS rules and deadlines you need to know to avoid hefty taxes and penalties.

Learn how the SEC's move to a T+1 settlement cycle impacts your investments, enhances market efficiency, reduces risk, and improves liquidity. Stay informed on the benefits and implications for your portfolio management and cash flow.

Explore the essential vocabulary of trusts, including the roles of trustees and beneficiaries, and the differences between revocable and irrevocable trusts.

The Magnificent Seven has been discussed extensively in investing circles. But what are the risks, particularly for the companies that have been leading the market to all-time highs?

While elections can certainly be an emotional time, they are not the time to make drastic investment decisions based solely on election outcomes.

Maximize your retirement wealth by understanding the complexities beyond market timing. Learn how our personalized approach to retirement investing considers your unique goals, going beyond the 'one size fits all' strategy.

There are a number of challenges parents in the sandwich generation face when helping with the financial decisions of their adult children.

Chances are, you have a child or grandchild who will be attending college in the near future. Along with bright hopes for the next chapter comes a common concern: how will the costs of post-secondary education be paid?

Effective investment strategies tailored to various life stages help ensure you mitigate the impact of sequence-of-returns risk. Safeguard your portfolio and financial well-being effectively during the transition from wealth accumulation to retirement.

Understand the differences between residency and domicile and their implications for tax planning. Explore a case study and learn key actions to establish domicile for potential tax benefits.

Given the jaw-dropping costs of long-term care and the odds of needing it at some point in life, many people are left wondering how they will pay for the medical treatment and assistance with the activities of daily living they may require in their later years.

Explore the transformative impact of Artificial Intelligence (AI) on investing and how it can be a valuable tool for informed decision-making.

Discover helpful strategies “sandwich-ers” can utilize when providing assistance and guidance to those they care about, while also balancing and protecting their own financial nest eggs in this two-part series.

Many people dream of having a place family can gather for vacation or a second home to spend winters once retired. Before making that purchase, there may be tax implications to consider.

As you’re wrapping up the year, don’t forget about your favorite causes! Most charities need your help to meet their year-end goals, so be generous but be smart with your gift-giving.

AI has become a disruptive force in the economy, raising questions about its impact on society. While AI has shown great promise in boosting stock returns, it also poses challenges concerning job losses, disinformation, and ethical considerations.

The importance of having a solid financial plan cannot be overstated. Financial planning serves as a guiding light, illuminating the path towards achieving your life's aspirations and ensuring a secure and comfortable future.

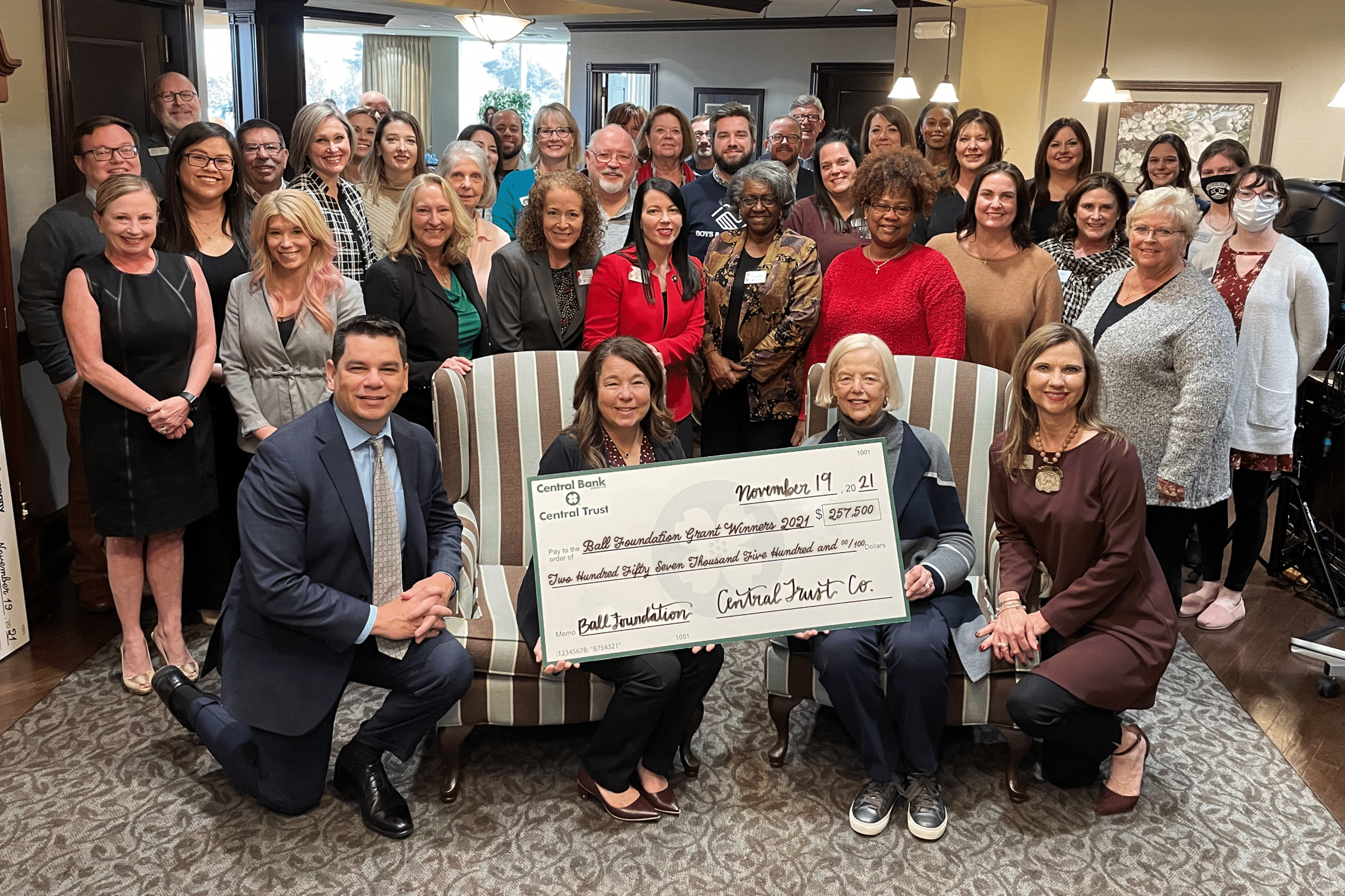

The Stanley & Elaine Ball Foundation, managed by Central Trust Company, awards the 2023 local, non-profit grant recipients.

Fall is in the air, and the US stock market has taken its cue, with the S&P 500 index posting the worst month this year, falling 4.77%. Bonds were not much better, falling 2.54% for the month.

Prepare for Medicare's Annual Open Enrollment: What You Need to Know. Get a comprehensive overview of Medicare, including important changes for 2023, and make informed healthcare coverage decisions.

When choosing your team of trusted advisors to manage your hard-earned money and investments, always verify that they adhere to the fiduciary standard.

When it comes to managing your Medicare coverage, the annual Open Enrollment period is a crucial opportunity to ensure that your healthcare plan aligns with your evolving needs. Navigate Medicare Open Enrollment with Confidence by avoiding these 5 common mistakes.

In the heat of summer, returns across both stocks and bonds were decidedly cold. The main driver of underperformance for the month was expectations of the future path of interest rates.

Knowing when to take Social Security benefits is a common concern during financial planning discussions. Access valuable resources and make informed decisions for your unique situation with professional guidance.

Generate income for your portfolio by utilizing effective portfolio income methods like Tax-Loss Harvesting and Covered Call Writing. Learn how these methods work and how to implement them to optimize your earning potential.

Find out how top executives navigate complex financial landscapes, from estate planning to retirement. Ensure a seamless transition into retirement with an integrated approach and a team of advisors focused on your best interests.

Plan ahead and take control of your retirement journey. Follow three simple steps to help safeguard your nest egg against the potential for unpredictable stock market performance.

June continued a run of surprising stock market returns for 2023. One month does not make a trend, but it's comforting to see stocks perform positively.

Good health is vital to living a happy and successful life. Discover the power of Health Savings Accounts in connecting your health and wealth.

Maybe you don’t get the big cake and piles of presents like when you were a kid, but birthdays are still worth celebrating. When it comes to financial planning, each milestone birthday brings new benefits and opportunities.

One thing that does not get talked about enough are medical costs which go beyond Medicare. These costs can be complex and ever-changing.

The Stanley & Elaine Ball Foundation, managed by Central Trust Company, is happy to announce the 2022 local, non-profit grant recipients.

When a family owns land, it can mean many things to different members of the family. Working with a team of professionals to plan for your estate is an important decision to reach the desired outcome for your legacy property.

Anything that could affect a family or individual financial situation today, or in the future, brings with it the need to reevaluate where you are today, where you would like to be and if you are track to get there.

Each quarter, our investment team provides details on the market and economy, bringing you the latest insights in an easy to follow video.

Women are a large part of the workforce. They are often times directly involved in their households’ investment and financial decisions.

Given the recent volatility in the stock market, now might be a good time to consider a taxable Roth conversion.

There is more to financial planning than setting some goals and pinching some pennies. Here are five basic benefits that may come from working with a financial planner on an organized financial plan.

Probate can be public, time consuming, and expensive. But, it can also be easily avoided when the proper steps are taken.

There has been a lot of discussion over the past several years regarding cryptocurrency. If you feel like the whole idea of cryptocurrency is hard to understand, you are not alone.

While Grantor Retained Annuity Trusts (GRAT) can seem complex to some, they can really be simple when broken down. Because GRATs have the potential to provide significant tax benefits when interest rates are low, today’s interest rate environment may provide a good opportunity.

Incapacity can befall anyone at any time. The best way to protect your family and assets in the event that disability strikes is to take the necessary steps when there is no doubt that you are fully capable of acting on your own behalf.

Many of us understand and recognize inflation. What we don’t know is how high it will go or how long it will last.

One of the biggest questions we hear from clients is, “What kind of retirement lifestyle can I afford?” It’s not easy to forecast living expenses for next year, let alone to project the cost of a retirement period of 30 plus years.

It’s been said that health has more of an impact on our happiness than anything else. Some say financial contentment follows close behind, which makes the beginning of the year a perfect time to look at how we can improve our financial well-being.

At Central Trust Company, we use Monte Carlo Simulation to model a variety of outcomes— including all the events taking place this year.

Investing is, and will always be, a balancing act between “eating well" and "sleeping well”.

When contemplating an outright business sale to an outside entity, the first or foundational level of planning should be contingency planning.

As investors we all know things can turn on a dime. Take time to explore programs available to help you, your family, or friends when health or fortunes have changed direction.

The Stanley & Elaine Ball Foundation, managed by Central Trust Company, is happy to announce the 2021 local, non-profit grant recipients.

by Greg Berg, CFA, CAIA, MBA, Senior Vice President & Senior Portfolio Manager INVESTMENT OUTLOOK Global…

Regardless of the age of your children, the first step in educating them about finances is communicating what money means to you.

A common estate plan might provide that upon your death, your assets will be distributed to your children. While that has the benefit of being simple, there can be risks.

Our May/June 2021 Estate Planning Report is now available! Included is the feature article "DAF Notes". Also featured are Cases & Rulings and Washington Talk, a discussion of hot topics in the nation's capital.

Join our investment team for a look at our insights into the markets and the economy for the first quarter of 2021.

When was the last time you reviewed your estate plan? If you haven’t reviewed your plan since the day you originally signed documents at your attorney’s office, you’re not alone.

You’ve worked hard to accumulate an estate that you hope to pass onto your children, but have you talked to them about it?

When uncertainty is all around, proactive steps you take help mitigate your personal financial risk and the uncertainties of life and the certainty of death and taxes.

Navigating the financial industry can be daunting. More so for someone that may not have experience in the industry or be aware of the multiple service delivery models that are available.

The Stanley & Elaine Ball Foundation, managed by Central Trust Company, is happy to announce the 2020 local, non-profit grant recipients.

Variable annuities can be difficult for clients, and even some financial professionals, to fully understand.

With so many changes in the financial markets, it’s a good time to evaluate your investments.

In the latest edition of The Central View, our investment team dives into their thoughts on the economy, valuations, the upcoming election and our portfolio positioning as we navigate through Q3 2020.

Join our investment team for look at this quarter's insights into the markets and the economy.

The SECURE Act was intended to expand opportunities for taxpayers to save for retirement and to simplify administration for retirement accounts. It has resulted in unique challenges and planning opportunities in the estate planning arena.

Join our investment team for a look at this quarter's insights into the markets and the economy.

Here are some actionable ideas to coordinate your investment decisions with income tax strategies on your road to retirement.

While your chance of winning the lottery is extremely small, the challenges associated with managing a large influx of money are actually quite common.

Join our investment team for a look at this quarter's insights into the markets and the economy.

What’s unique about working with Central Trust Company is that we can advise you about our many service offerings outside of just the investment realm.

Regardless of the age of your children it is important to educate them about money and the concepts of earning, spending, saving, investing, and giving.

Market volatility can lead some investors to make quick decisions that can ultimately harm their long-term investing goals. It's important to know if you are investing with your emotions or remaining objective.

Join our investment team for a look at this quarter's insights into the markets and the economy.

Retirement means your regular paycheck has stopped and now you are in charge of managing your own cash flow.

The "Setting Every Community Up for Retirement Enhancement" bill was passed by the House on May 23 and could drastically change the rules of retirement.

Selling a business can be complicated and daunting – and may bear substantial tax consequences.

Join us for a look at this quarter's insights into the markets and the economy.

Having a will doesn't always mean you can avoid probate, but having a trust can be beneficial in avoiding it.

The success of your retirement depends largely on what you do with the money in your qualified retirement plan.

This edition of "Ask a Trust Officer," explains how getting organized now can save you a lot of time and stress as tax season officially kicks off.

Covers cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2019.

For philanthropic taxpayers, a unique tax planning opportunity exists when donations are sourced from IRA funds.

Although it has often been regarded as an unspeakable topic, it is important to talk to your family, especially your adult children, about finances before you are gone.

What you leave behind for your family and friends to treasure is important. However, the reason behind the heirloom may be even more important.

In a desire to eliminate paper clutter, do you have bills and statements come to…

One of the biggest causes of family arguments after the passing of a loved one is who gets the inheritance. By talking to your children about this early on, you are likely to avoid squabbles and provide meaning to what you are leaving behind.

By Greg Berg, CFA, CAIA - Senior Vice President & Senior Portfolio Manager After an…

The Internal Revenue Service announced on October 19, 2017 cost of living adjustments affecting dollar…

By J. Bryan Allee, J.D. - Vice President & Chief Fiduciary Officer According to…

By Trenny Garrett, J.D. - Senior Vice President & Relationship Manager Since the estate…

Deciding when and how to save for a child’s future college education, while saving for your retirement, is quite a balancing act.

Communicating with your grandchildren can be tough these days. They may live miles away and…

Latest Videos

Learn why having a trusted wealth advisor can make all the difference in your financial future. In this video, we explain the true role of a wealth advisor, from investments to retirement, education, tax strategies, and estate planning.

November brought plenty for investors to celebrate, with strong S&P 500 gains driven by Fed rate cuts and election outcomes.

October markets started strong but ended with volatility driven by AI concerns, small-cap losses, and global pressures, while precious metals held steady.

September brought market resilience amid volatility, with the S&P 500 rising and emerging markets outperforming, driven by economic shifts and global events.

When a family owns land, it can mean many things to different members of the family. Working with a team of professionals to plan for your estate is an important decision to reach the desired outcome for your legacy property.

Each quarter, our investment team provides details on the market and economy, bringing you the latest insights in an easy to follow video.

Women are a large part of the workforce. They are often times directly involved in their households’ investment and financial decisions.

There has been a lot of discussion over the past several years regarding cryptocurrency. If you feel like the whole idea of cryptocurrency is hard to understand, you are not alone.

While Grantor Retained Annuity Trusts (GRAT) can seem complex to some, they can really be simple when broken down. Because GRATs have the potential to provide significant tax benefits when interest rates are low, today’s interest rate environment may provide a good opportunity.

At Central Trust Company, we use Monte Carlo Simulation to model a variety of outcomes— including all the events taking place this year.

Investing is, and will always be, a balancing act between “eating well" and "sleeping well”.

When contemplating an outright business sale to an outside entity, the first or foundational level of planning should be contingency planning.

As a business owner or executive, you are most likely the fiduciary of your company’s retirement plan. As the plan’s fiduciary, you are responsible and liable for oversight of the plan’s administration, investments and fees.

by Greg Berg, CFA, CAIA, MBA, Senior Vice President & Senior Portfolio Manager INVESTMENT OUTLOOK Global…

A common estate plan might provide that upon your death, your assets will be distributed to your children. While that has the benefit of being simple, there can be risks.

Join our investment team for a look at our insights into the markets and the economy for the first quarter of 2021.

The changes and disruptions incurred in 2020 are well known and documented. But there is a new optimism, as roughly 80% of travelers have established plans during the next six months.

When uncertainty is all around, proactive steps you take help mitigate your personal financial risk and the uncertainties of life and the certainty of death and taxes.

Navigating the financial industry can be daunting. More so for someone that may not have experience in the industry or be aware of the multiple service delivery models that are available.

Variable annuities can be difficult for clients, and even some financial professionals, to fully understand.

With so many changes in the financial markets, it’s a good time to evaluate your investments.

In the latest edition of The Central View, our investment team dives into their thoughts on the economy, valuations, the upcoming election and our portfolio positioning as we navigate through Q3 2020.

Join our investment team for look at this quarter's insights into the markets and the economy.

What’s unique about working with Central Trust Company is that we can advise you about our many service offerings outside of just the investment realm.

Regardless of the age of your children it is important to educate them about money and the concepts of earning, spending, saving, investing, and giving.

Having a will doesn't always mean you can avoid probate, but having a trust can be beneficial in avoiding it.

This edition of "Ask a Trust Officer," explains how getting organized now can save you a lot of time and stress as tax season officially kicks off.

One of the biggest causes of family arguments after the passing of a loved one is who gets the inheritance. By talking to your children about this early on, you are likely to avoid squabbles and provide meaning to what you are leaving behind.

Deciding when and how to save for a child’s future college education, while saving for your retirement, is quite a balancing act.